Crypto is no longer a gray-area hobby in Vietnam. With the implementation of the Vietnam crypto law 2025, both individuals and companies now have a legal framework to participate in digital finance. This move represents a landmark transition — from regulatory uncertainty to structured governance. But what exactly can you do, and what remains off-limits under the new framework? Below are practical, real-world answers for users trying to navigate Vietnam’s newly regulated crypto landscape.

1. Is It Legal to Buy and Sell Crypto in Vietnam Now?

Yes. Buying, selling, and holding cryptocurrencies is officially legal under the new Vietnam crypto law. Individuals can trade assets like Bitcoin, Ethereum, and stablecoins using registered platforms. Peer-to-peer (P2P) trades are also permitted, provided both parties use identity-verified wallets.

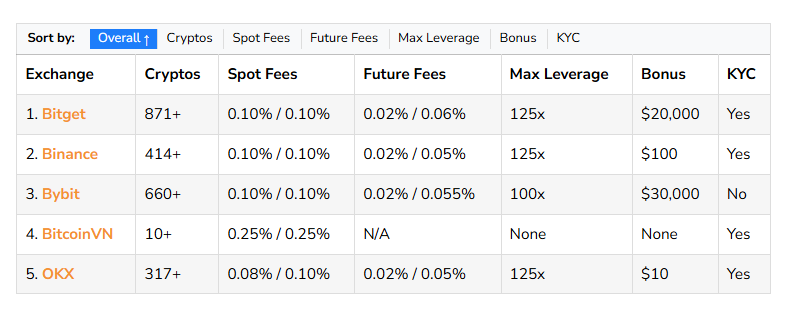

Exchanges operating in Vietnam must now be licensed under the country’s VDA rules. These platforms are required to meet local data storage standards, implement KYC (Know Your Customer) procedures, and report transactions over a certain threshold to the authorities. This oversight aims to reduce fraud, scams, and untraceable capital flows.

2. What Are VDA Rules, and How Do They Work?

Credit from ForumIAS

VDA stands for Virtual Digital Asset — a new legal category that includes cryptocurrencies, NFTs, and tokenized securities. Vietnam’s law classifies VDAs based on their function and use case:

- Payment tokens (e.g., stablecoins)

- Utility tokens (used within platforms or apps)

- Investment or security tokens (with tradable value or profit expectations)

Each VDA type comes with its own licensing, tax, and disclosure obligations. Payment and utility tokens are generally more flexible, while security or fundraising tokens must go through formal regulatory review. Issuers must publish whitepapers, disclose financial risks, and adhere to ongoing compliance checks.

3. Can I Use Crypto to Pay for Goods and Services?

Credit from CryptoWinRate

Technically yes, but with important caveats. Vietnam still does not recognize any cryptocurrency as legal tender. This means businesses are not obligated to accept crypto as payment. However, private agreements between buyer and seller are allowed under the law.

Some cafes, tech freelancers, and cross-border ecommerce merchants have started accepting crypto — usually via licensed intermediaries such as USDT wallets or QR-based platforms. Still, these payments must be reported and may trigger tax obligations if used in commercial contexts. The law encourages transparency, especially for business-related usage.

4. Do I Have to Report My Crypto Holdings in Vietnam Crypto Law 2025?

Yes. The government considers crypto a reportable financial asset. Vietnamese residents must declare gains or losses from trading, staking, or selling crypto in their annual income tax filings. The General Department of Taxation has collaborated with major platforms to improve data sharing and audit support.

Failure to report crypto income could result in administrative penalties. While there’s no wealth tax on holding crypto per se, any realized profits must be reported — even if you move funds between wallets or convert to stablecoins. The goal is to align digital finance with existing tax norms.

5. What if I Received Tokens for Free — Like an Airdrop?

Credit from Binance

Even free tokens may be taxable. The law treats airdrops, staking rewards, mining income, and referral bonuses as taxable events. The value is based on the market price at the time you receive the tokens.

If you later sell these tokens for a profit (or loss), the difference must also be declared. While current enforcement still relies heavily on self-reporting, the government plans to mandate annual earning statements from licensed exchanges. These statements will simplify tax filing, especially for users who trade frequently or use multiple platforms.

6. Are Crypto Startups Allowed in Vietnam?

Yes — but only with compliance. New ventures that involve token issuance, DeFi protocols, NFT platforms, or digital asset fundraising must register as VDA service providers. The Ministry of Finance issues these licenses, which require strict documentation.

Startups must meet capital adequacy ratios, publish risk disclosures, and implement cybersecurity frameworks. A whitepaper, tokenomics report, and investor risk statement are required before going to market. Projects that bypass these rules may face legal action or delisting from licensed exchanges.

While these measures raise the entry barrier, they also increase trust for investors and regulators.

7. What Happens If I Use an Unlicensed Exchange in Vietnam Crypto Law 2025?

Unlicensed platforms are now considered high-risk and non-compliant under the Vietnam crypto law. Users who trade through offshore or unregulated exchanges may face legal uncertainty, loss of funds, or tax complications.

Vietnamese authorities have started partnering with global regulatory bodies to trace suspicious transactions and flag unlicensed providers. Repeated violations — such as hiding foreign wallet income or bypassing KYC — could result in blocked transfers, wallet freezing, or administrative fines.

To protect users, the government maintains a public list of licensed exchanges and service providers. Using these platforms ensures legal safety and smoother tax processing.

Conclusion of Vietnam Crypto Law 2025: Structure Brings Stability to Vietnam’s Crypto Future

The Vietnam crypto law 2025 is not about limiting participation — it’s about organizing it. By introducing VDA rules, licensing pathways, tax enforcement, and classification categories, the government aims to turn Vietnam into a credible, secure player in the global blockchain space.

For everyday users, this law brings clarity: you can now trade and own crypto without fear of legal ambiguity. For startups and businesses, the rules offer a framework for innovation with clear legal guardrails.

Crypto in Vietnam is no longer underground — it’s entering the mainstream with a regulatory backbone designed for long-term growth.