When it comes to Ethereum vs Bitcoin Singapore, most global headlines still focus on price swings and social media hype. However, in Singapore, the comparison is unfolding differently. By the latest 2025 update, the conversation has shifted—from speculation to infrastructure, regulatory fit, and actual economic integration. Because of that, Ethereum is starting to pull ahead.

And in a city like Singapore, where regulation and innovation often go hand in hand, that kind of shift matters more than noise.

Ethereum vs Bitcoin Singapore: A Practical Divide

Created By fintechnews

Bitcoin may still dominate in market cap, but in Singapore, practicality often outpaces popularity. Ethereum, built for flexibility and function, aligns far more closely with what the local fintech and Web3 industries actually need.

Here, it’s not just about buying and holding. From DeFi protocols to NFT use cases, Ethereum smart contracts in Singapore are powering actual apps and financial experiments. Bitcoin, by contrast, offers fewer tools for builders. It’s solid—but limited.

That functional difference is shaping the direction of adoption.

Why MAS Project Guardian Favors Ethereum-Based Platforms

Created By ledgerinsights

In 2025, one of the clearest indicators of institutional leanings is MAS Project Guardian. Spearheaded by the Monetary Authority of Singapore, the project focuses on tokenization, programmable money, and regulated DeFi pilots.

So far, most of these pilots are built on Ethereum-compatible chains. The reason? Ethereum offers modular programmability, meaning compliance tools, governance rules, and user permissions can be built directly into financial protocols.

Bitcoin, while resilient, can’t offer this kind of infrastructure. And that limits its utility in structured, policy-driven environments like Singapore.

Ethereum Merge Impact: ESG and Energy Matter in Singapore

Created By burohappold

Back in 2022, Ethereum’s shift to proof-of-stake (The Merge) drastically reduced its energy usage—by over 99%. At first, it was seen as a technical shift. But by 2025, it’s become a defining factor in ESG crypto investing.

In Singapore, where sustainability reporting is part of financial compliance, Ethereum’s low carbon profile has made it the preferred chain for institutions. Bitcoin, still operating under proof-of-work, raises red flags for ESG-focused asset managers and CFOs.

Here, low emissions aren’t just a bonus—they’re a requirement.

Tokenization in Singapore: Ethereum Is the Default Rail

Created By cryptoslate

Singapore’s fintech sector has fully embraced the tokenization trend, from fractional real estate to green bonds and invoice financing. And while there are competitors in the space, Ethereum continues to dominate tokenization in Singapore.

Why? Familiarity, tooling, and protocol maturity. Standards like ERC-20 and ERC-1400 allow developers and auditors to work on common ground, which accelerates implementation. More importantly, regulators understand them.

That comfort factor makes Ethereum the default rail—not because it’s the only option, but because it’s the safest.

Crypto Adoption in Singapore Is Growing, Quietly and on Ethereum

Created By independentreserve

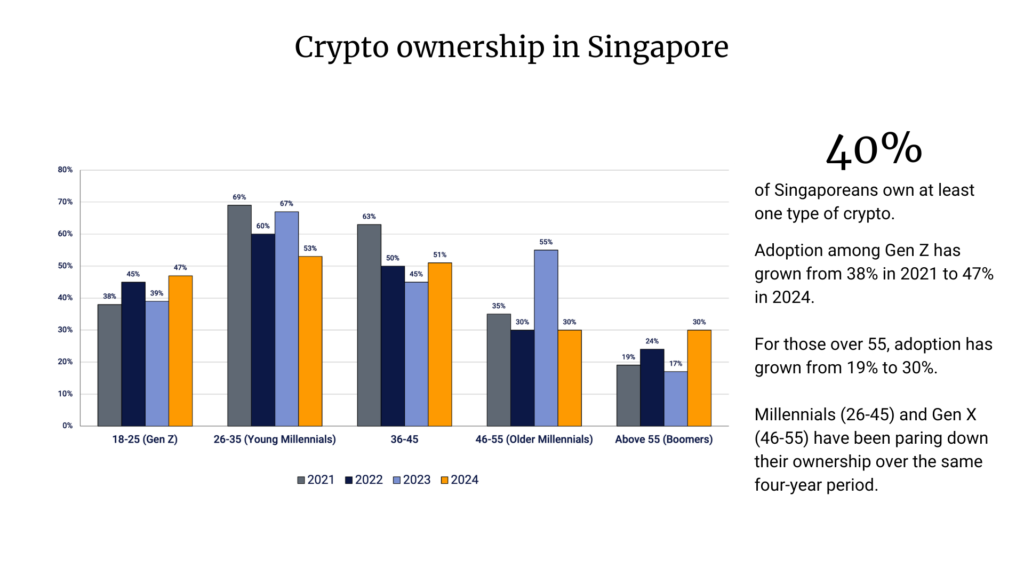

Walk into a co-working space in Telok Ayer or attend a Web3 panel near Clarke Quay, and you’ll see the pattern. While Bitcoin is still part of macro conversations, crypto adoption in Singapore is increasingly happening through Ethereum.

Builders use it. Institutions test on it. Developers trust it. From MetaMask integrations to Solidity-powered apps, Ethereum is the foundation for day-to-day crypto use.

In other words, Bitcoin may be what people own—but Ethereum is what they use.

Conclusion: Ethereum vs Bitcoin Singapore in 2025

So—is Ethereum “winning” the race in Singapore? Not in every sense. Bitcoin is still a powerful reserve asset. But in the context of functionality, compliance, and integration, Ethereum is clearly ahead.

Because of its ESG credentials, regulatory flexibility, and infrastructure readiness, Ethereum is no longer just a blockchain—it’s becoming part of Singapore’s digital economic backbone.

And that, in 2025, might be the only “outperformance” that truly matters.