1. Gold Hedge Rupiah — What’s It All About, Really?

The concept is pretty straightforward: when the rupiah loses value, gold often gains in price when measured in IDR. So, holding gold becomes a way to “hedge” — to offset losses in your local currency’s buying power. It doesn’t guarantee profits, but it can soften the blow during unstable times. That’s why more people are asking how to start a gold hedge rupiah strategy in 2025.

2. How Does Gold Hold Its Value When the Rupiah Falls?

Source: Investing.com

Gold is priced globally in US dollars. So if the rupiah weakens, but gold stays flat in USD terms, its price in IDR still rises. For example, if gold sits at USD 2,200 per ounce, and the rupiah goes from 15,000 to 16,500 — boom, that same ounce now costs more in local currency. That’s the basic mechanism behind why gold works as a hedge.

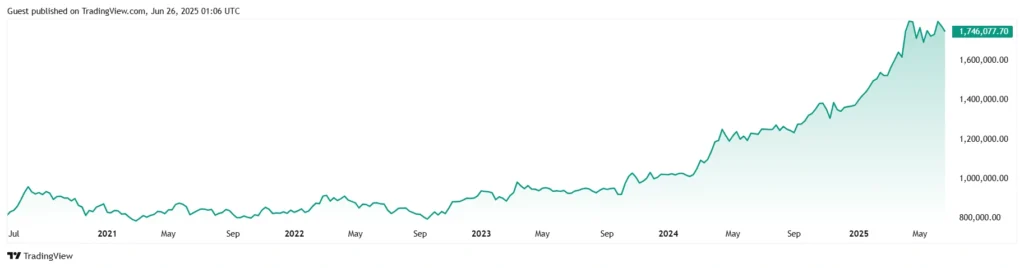

3. Is Gold Always a Good Hedge — Or Are There Times It Doesn’t Work?

Source: TradingView

Good question. While gold usually moves in your favor during a currency slump, it’s not a sure thing. If global gold prices drop at the same time the rupiah weakens — which can happen — the hedge might not help much. Plus, markets can behave oddly in the short term. So, is gold perfect? Nope. Is it reliable most of the time? Pretty much.

4. What Are the Easiest Ways to Start it Indonesia?

There are more options than ever today:

- Antam gold bars or coins — trusted, physical, but bulky to store

- Jewelry — easy to buy, but includes added cost for craftsmanship

- Digital gold platforms — apps like Lakuemas, Tokopedia Emas, or Pluang let you buy gram-by-gram

- Gold-backed ETFs or funds — if you’re already investing online

Just make sure to compare fees and make sure you can sell easily if needed. Accessibility matters a lot when you’re using gold as a financial fallback.

5. When’s the Right Time to Start Hedging With Gold?

Honestly, before the trouble starts is ideal — that’s the point of hedging. Some common red flags?

- The rupiah’s dropping steadily

- Fuel or import prices are rising

- Global markets seem stressed (US rate hikes, China slowdown, oil shocks)

- You’re feeling unsure about where to park long-term savings

Even just putting aside a small percentage of your portfolio in gold can offer some peace of mind.

6. What Should You Watch Out for With a Gold Hedge Strategy?

A few things to be mindful of:

- Gold doesn’t pay income like deposits or stocks

- Buying at peak prices can reduce returns

- Fake products or bad sellers can be a risk for physical gold

- Liquidity issues — if you buy something hard to sell quickly

Also, don’t assume gold alone can solve all financial uncertainty. It’s best used with other tools like foreign currency savings or conservative investments — not as your only move.

7. Is a Gold Hedge Still Worth It in 2025?

For many Indonesians, the answer is yes. With the rupiah still under pressure now and then, and inflation a lingering concern, holding some gold remains a smart, time-tested strategy. The key is not to go overboard. Use gold as a buffer — not a bet. That’s the heart of the gold hedge rupiah idea: protect, not gamble.