Forex Indonesia: At their core, both services deal with foreign currencies — but their functions, users, and methods are very different. Forex trading is done online and focuses on buying and selling currency pairs to make a profit based on exchange rate movements. It’s speculative and typically used by investors, hobby traders, or finance professionals. Money changers, on the other hand, are physical outlets where people exchange one currency for another — usually for practical purposes like travel or business payments.

In the Indonesian context, the term Forex Indonesia now includes both the growing digital trading community and the longstanding presence of physical money changers across the country. Even though both fall under the currency exchange umbrella, they serve completely different needs.

Forex Indonesia: How does forex trading work in Indonesia?

In Indonesia, forex trading happens through online platforms provided by licensed brokers. Users open accounts, deposit funds, and start trading currency pairs such as USD/IDR, EUR/JPY, or GBP/USD. The aim is to profit from small changes in exchange rates — for example, buying a currency low and selling it high. This type of trading is typically done using leverage, allowing traders to control larger positions with a smaller amount of capital.

Trading in this way involves risk, knowledge, and fast decision-making. The platforms are open 24 hours a day, five days a week, in sync with global forex markets. Indonesian traders are advised to only use brokers registered with BAPPEBTI, the government agency that regulates futures and forex trading. While it’s part of the broader Forex Indonesia landscape, this type of activity requires a strong understanding of finance and the discipline to handle gains and losses.

Forex Indonesia: What does a money changer do, and who usually uses one?

Source: The Jakarta Post

Money changers provide a straightforward, in-person service. You bring your Indonesian rupiah (or any other currency), and they convert it into your desired foreign currency, such as US dollars, yen, or euros. These services are commonly used by tourists, overseas workers, business owners, and students studying abroad. Transactions are simple — the rate is posted, the cash is exchanged, and the process is typically completed within minutes.

In Indonesia, money changers are regulated by Bank Indonesia, which ensures they operate legally and transparently. They must comply with anti-money laundering rules and provide fair, visible exchange rates. Many users prefer money changers for their convenience, particularly when handling physical cash for immediate use. This traditional side of Forex Indonesia remains vital, especially for people without access to or interest in online financial platforms.

Forex Indonesia: Are both forex trading and money changers regulated in Indonesia?

Source: Pasardana

Yes — but by different authorities, and under different regulations. Money changers are supervised by Bank Indonesia, which ensures that these outlets are licensed, track transactions, and follow standard exchange rate practices. These businesses are required to report suspicious activity and are regularly audited.

On the other side, forex trading platforms are regulated by BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi). Only brokers licensed by this body are allowed to offer trading services in Indonesia. This separation helps ensure that traders are protected from fraud and that operators follow financial compliance rules. As Forex Indonesia evolves, so does the framework that keeps both services in check and protects users on either path.

Which is safer: forex trading or using a money changer?

Source: Faizsulaiman

It depends on what you’re trying to do. If you’re exchanging money for travel or personal use, licensed money changers offer a safer, more predictable route. There’s minimal risk — you receive physical currency immediately at a clearly posted rate. This makes it suitable for casual users and one-time transactions.

Forex trading, by contrast, carries a higher risk. There’s potential to earn, but also to lose, especially when using leverage or trading during volatile market conditions. It’s better suited for users who are financially literate and ready to invest time in research and strategy. In the broader scope of Forex Indonesia, money changers cater to stability, while trading platforms offer opportunity — and risk.

Why are the exchange rates different?

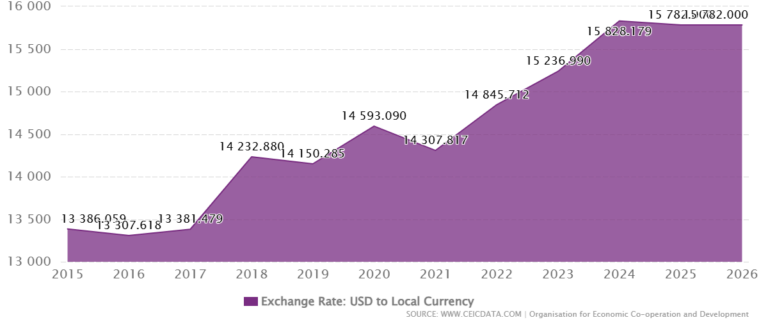

Source: ceicdata

Money changers set their own buying and selling rates, which usually include a built-in margin as their service fee. These rates can vary depending on the outlet, its location, and the demand for certain currencies. For example, an exchange booth at an airport might offer slightly less favorable rates than one in a central business district.

Forex trading platforms, on the other hand, reflect real-time prices based on global interbank rates. While these rates are more aligned with the actual market, brokers still charge a spread (the difference between buy and sell prices) or a commission per trade. The benefit is greater accuracy, but it comes with trading fees and the need to monitor price movements. In short, exchange rates differ because the services — and the purposes behind them — are different sides of Forex Indonesia.

Who are the typical users of each service?

Source: Workitdaily

Money changers are used by everyday consumers — anyone needing currency for immediate use. This includes vacationers, Indonesians working overseas, families sending money to students abroad, or businesses paying foreign vendors. These users usually value speed, transparency, and face-to-face service.

Forex traders, in contrast, tend to be younger, more digital-savvy individuals looking for new investment channels. Many are drawn to the global aspect of forex markets and the flexibility of trading from home. Some trade full-time, others do it as a side interest. Forums, webinars, and trading apps have made it easier than ever to join this space. As Forex Indonesia continues to evolve, this community of users is expected to grow — but so is the need for financial education and regulation.

Conclusion

Understanding how forex trading and money changers differ is essential for anyone dealing with currency in Indonesia. The term Forex Indonesia today refers to more than just one activity — it captures a spectrum ranging from speculative online trading to the everyday use of local exchange outlets. Whether you’re traveling abroad or exploring the currency markets, knowing the legal, practical, and financial aspects of each service can help you make smarter, safer decisions. These two options aren’t in competition — they simply serve different needs in a diverse and growing economy.