Trading Mistakes Beginners Indonesia: Trading in financial markets, particularly forex and cryptocurrency, has become increasingly accessible to Indonesians. With just a smartphone and a trading app, anyone can start buying and selling financial instruments. However, this accessibility often comes at a cost, as many beginner traders enter the market with high hopes but little preparation. The reality is, trading is not a guaranteed path to riches—it’s a high-risk activity that demands knowledge, discipline, and emotional control. Most beginners underestimate the psychological and strategic demands of the market, leading to impulsive decisions, emotional trading, and rapid financial losses. Understanding the trading mistakes beginners Indonesia typically make is essential not only to preserve capital but also to develop a strong trading foundation for long-term success.

Trading Mistakes Beginners Indonesia: Jumping into Live Trading Too Early

Source: Sinar Harapan

One of the most frequent and costly mistakes made by new traders is entering the live market with real money before acquiring the necessary skills and experience. Many beginners, motivated by the desire for quick profits or influenced by social media success stories, skip demo trading altogether. This eagerness to trade live can backfire badly, as they lack a true understanding of how the market behaves under pressure. Trading in a demo account allows one to get familiar with chart patterns, test different strategies, and experience market volatility in a risk-free environment. It helps traders refine their timing, understand their emotional responses, and build confidence. Beginners in Indonesia should treat demo trading not as an optional phase, but as a mandatory part of their learning journey. Skipping it often results in panic-driven decisions, inconsistent performance, and preventable losses in a real-money account.

Trading Mistakes Beginners Indonesia: Starting with Too Much Capital

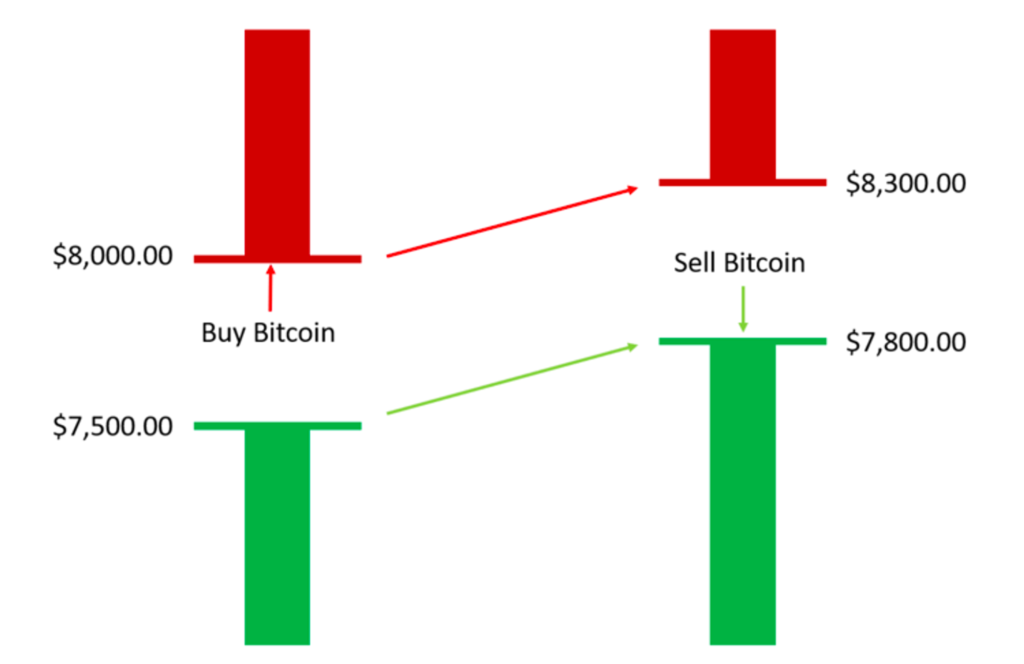

Source: CRYPTO WEEKLY

New traders often enter the market with unrealistic expectations and start trading with more money than they are emotionally or technically ready to handle. They believe that putting in more capital will generate higher returns more quickly. Unfortunately, this approach usually leads to faster and larger losses, especially when the trader is inexperienced. Trading with a big account amplifies emotional stress, making it harder to stick to a plan when trades go against expectations. Greed and fear become more powerful, often pushing traders into revenge trading or doubling down on losing positions. Instead, starting small helps reduce psychological pressure and allows beginners to make mistakes without losing substantial amounts of money. In the Indonesian trading landscape, where accessibility is high but financial literacy is still growing, starting with minimal capital and gradually scaling up as confidence builds is a much safer and more effective approach.

Trading Mistakes Beginners Indonesia: Trading Without a Clear Plan

Source: PINTU

A solid trading plan acts as a roadmap that guides every decision a trader makes, yet many beginners trade without one. Instead of having structured rules for when to enter or exit trades, how much to risk, and which setups to prioritize, they trade based on impulse, news hype, or gut feelings. This lack of structure often results in inconsistency, overtrading, and emotional reactions to normal market movements. A good trading plan includes clearly defined rules for entry and exit, position sizing, risk-to-reward ratios, and overall strategy. It should also outline how to respond to different market conditions, such as ranging versus trending markets. Without a plan, beginners are essentially gambling, hoping for favorable outcomes without understanding the process. Especially in fast-paced markets like forex and crypto, where prices can change drastically within seconds, having a plan is not optional—it’s a necessity for survival.

Lack of Discipline and Chasing Losses

Discipline is one of the most underrated traits in trading, yet it is also one of the most important. Beginners often struggle to stick to their strategies, especially after a string of losses or missed opportunities. They start modifying their setups mid-trade, increasing position sizes irrationally, or trying to recover losses by making bigger bets. This behavior, known as “revenge trading,” is fueled by emotion rather than logic, and it typically leads to further losses. In the Indonesian context, where trading is often seen as a way to supplement income or achieve financial freedom quickly, the temptation to recover losses fast can be very strong. However, the key to long-term success lies in maintaining emotional control, sticking to your rules, and accepting losses as part of the journey. Trading should be approached with a mindset of discipline and process, not desperation and instant gratification.

Trading Mistakes Beginners Indonesia: No Risk Management Strategy

Source: Upstox

Many beginner traders in Indonesia enter the market without a proper risk management system in place, which is one of the fastest ways to blow up a trading account. They either do not use stop-loss orders or set them arbitrarily without considering the volatility of the asset they are trading. Some even risk more than 20% of their capital on a single trade, hoping to double their money quickly. This lack of risk control exposes their entire account to a few bad trades. Proper risk management means limiting your risk per trade—often to 1-2% of total capital—while also using stop-loss and take-profit levels that align with the overall strategy. It also involves understanding position sizing and not over-leveraging. Risk control is not just about avoiding large losses; it’s about staying in the game long enough to develop skill and consistency.

Failing to Protect the Trading Account

Protecting your capital should always be a trader’s top priority, especially in the early stages. However, beginners often make the mistake of focusing solely on how much they can gain rather than how much they can lose. They fail to set daily loss limits, continue trading during emotional stress, or leave open trades running overnight without stop-losses. These actions put their entire account at risk. Implementing daily loss limits helps prevent emotional decisions and preserves mental clarity. It’s also crucial to secure trading platforms with two-factor authentication and avoid public Wi-Fi when logging in. In addition, regularly withdrawing a portion of profits is a way to protect earnings and avoid overexposure. Ultimately, surviving in the market is about staying cautious, preserving your account balance, and maintaining your ability to trade another day.

Trading Psychology: Mastering the Mind Behind the Market

Source: InvestaDaily

A trader’s worst enemy is often not the market, but their own emotions. Fear of missing out (FOMO), greed, impatience, and frustration can override logic and discipline, leading to poor decisions. Beginners may enter trades too late due to FOMO or stay in losing trades hoping for a reversal. These behaviors are emotionally driven and have little to do with solid strategy. Understanding and managing your psychology is just as important as analyzing charts or reading news. It involves self-awareness, emotional regulation, and being comfortable with uncertainty. Journaling trades, reflecting on emotional triggers, and practicing mindfulness can help in building emotional discipline. For Indonesian traders navigating volatile markets and online hype, staying grounded mentally is crucial for long-term success.

Bouncing Back from a Major Loss

Experiencing a major loss can be demoralizing, but it’s also an opportunity for growth. Many beginners take losses personally and respond by quitting or trying to recover quickly, often with worse results. The right way to handle a setback is to pause and evaluate. What went wrong? Was it a strategy flaw, emotional error, or lack of preparation? Taking time to review trades, analyze patterns, and identify recurring mistakes helps in building a stronger approach moving forward. It’s also helpful to reduce trade sizes temporarily, return to demo trading, or focus on education while regaining composure. Resilience in trading doesn’t come from avoiding losses, but from how effectively you bounce back from them. In Indonesia’s active trading community, stories of traders who rebuilt after setbacks are common and inspiring—but they all begin with a clear, honest reflection.

Smart Strategies and Continuous Learning

Markets evolve constantly, and strategies that work today may not work tomorrow. This is why continuous learning is essential for all traders, especially beginners. Successful traders read books, follow economic calendars, attend webinars, and stay updated with global news. They also refine their strategies over time through backtesting, journaling, and community engagement. In Indonesia, traders have access to local and international resources—both in Bahasa Indonesia and English—that can significantly accelerate learning. By investing in education and staying curious, traders can adapt to new conditions, spot emerging trends, and avoid stagnation. The more informed and prepared you are, the better your chances of navigating market uncertainty.

Avoiding Crypto-Specific Mistakes

Source: Mantra

The crypto market, with its extreme volatility and unregulated nature, presents unique risks that forex does not. Beginners often get swept up by hype and invest in coins without understanding their purpose, tokenomics, or security models. Others may rely too heavily on influencers, Telegram signals, or social media trends, which are often unverified or manipulated. Additionally, many fail to properly secure their funds, storing assets on hot wallets or exchanges that lack adequate protection. New crypto traders in Indonesia must prioritize research, understand blockchain fundamentals, and learn to use cold wallets for asset storage. Avoiding scams, pump-and-dump schemes, and speculative altcoins is essential. Crypto offers opportunity, but only for those who treat it with caution, not blind enthusiasm.

Conclusion: Trade Smarter, Not Harder

Success in trading doesn’t come from taking more trades or chasing bigger wins—it comes from avoiding major mistakes and learning continuously. For beginners in Indonesia, the journey starts with understanding the trading mistakes beginners Indonesia are most prone to and developing habits that protect capital and promote growth. A disciplined mindset, clear strategy, solid risk management, and ongoing education are the pillars of a sustainable trading career. It’s not about beating the market, but about staying in the game long enough to evolve with it. Learn from your experiences, refine your approach, and commit to progress—not perfection.