Forex Time Zones Decoded: Best Trading Hours for Asian Traders

The 24-hour nature of forex may feel limitless, but timing still plays a central role in trading success — especially in Asia. Whether you’re based in Vietnam or elsewhere in the region, understanding when the market truly “wakes up” can make the difference between chasing volatility and working with it. Below, we explore some of the most common — and relevant — questions about forex time zones and best trading hours for Asian traders.

1. Why do forex time zones matter for Asian traders?

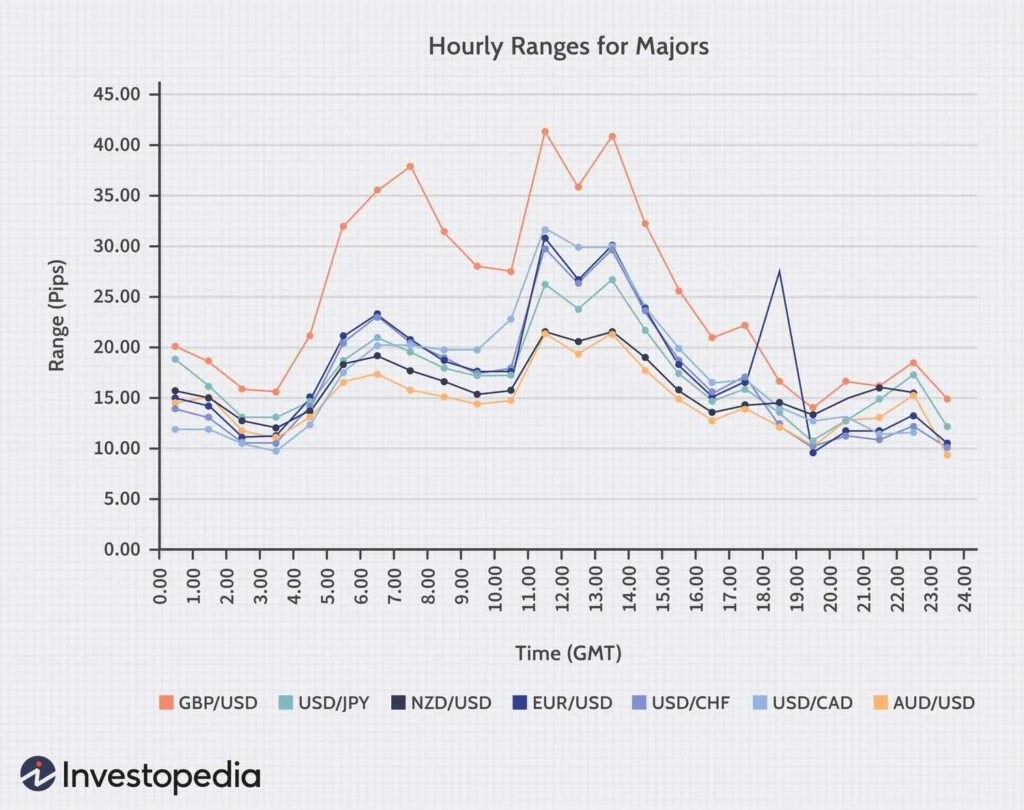

Credit from Investopedia

Because the forex market never sleeps — but you do. The market operates in major sessions tied to global financial centers: Tokyo, London, New York, and Sydney. These time zones dictate when volume, volatility, and momentum peak. For traders in Asia, being in sync with these windows means aligning trades with periods of higher activity, better spreads, and stronger trends.

2. What are the typical trading sessions in Vietnam local time?

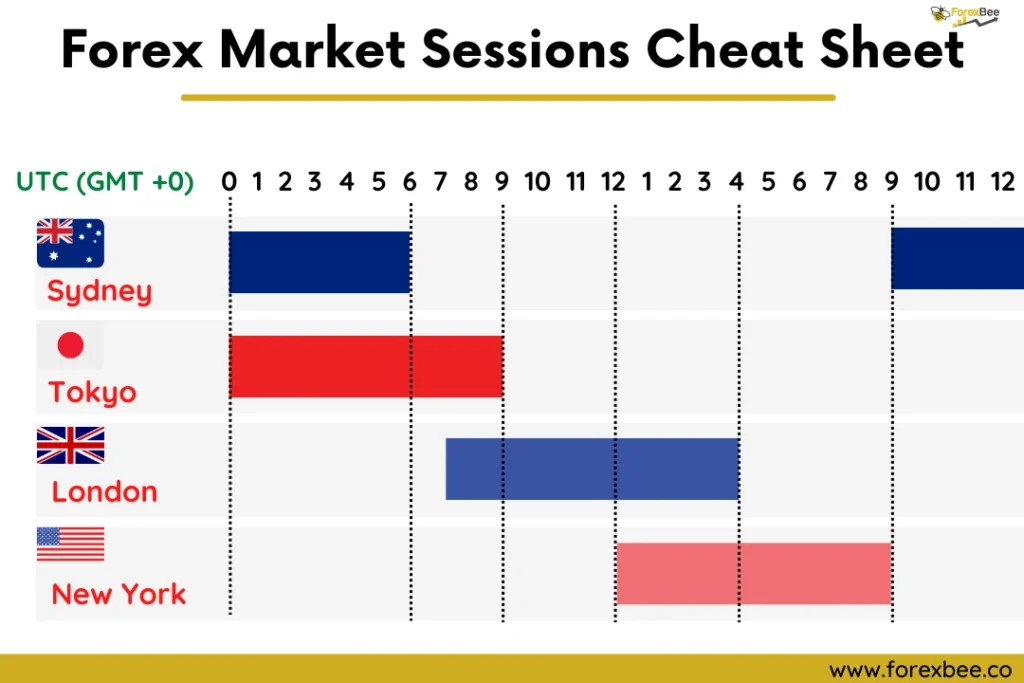

Credit from ForexBee

Here’s how global sessions generally align with Vietnam forex hours (GMT+7):

- Tokyo Session: 6 AM – 3 PM

- London Session: 2 PM – 11 PM

- New York Session: 8 PM – 5 AM (next day)

- Sydney Session: 4 AM – 1 PM

For most Vietnam-based traders, this means the Vietnam forex session naturally overlaps with the Asian open in the morning and ramps up into the London afternoon. The real action tends to start mid-afternoon.

3. What is the best Forex Time Zones in Vietnam?

Credit from DataWallet

While individual strategies differ, the best forex time in Vietnam typically falls between 2 PM and 10 PM, when the London market is active. If you can stretch into the evening hours (around 7–10 PM), you’ll also catch the London–New York overlap — one of the most volatile and liquid periods globally.

4. Is it okay to trade during quiet hours, like early morning in Vietnam?

Yes, but expectations should be adjusted. The early Vietnam morning (5–8 AM) sits within the Sydney–Tokyo crossover, which offers relatively low volatility. This window suits traders looking for slow-moving setups or range-bound strategies — but not those chasing breakout momentum. Think of it as a prep window: scan charts, plan, and set alerts.

5. How does the Vietnam time zone affect market overlap opportunities?

Credit from FXOpen UK

Vietnam’s time zone gives traders direct access to the Asia-London overlap in the late afternoon and the London–New York overlap in the evening. This is a sweet spot. The key is to be selective — focus on high-volume currency pairs that reflect those sessions (EUR/USD, GBP/JPY, AUD/USD), and avoid spreading attention too thin.

6. Should I avoid trading during the lunch hour in Vietnam?

Many traders take a pause from 11 AM to 1 PM, and for good reason. This tends to be a lull between the close of Tokyo’s morning volatility and the open of London. That said, some traders do use this window for mid-day analysis or low-risk entries. It’s not about avoiding it entirely — just knowing what to expect.

7. Can part-time traders in Vietnam still succeed despite the timing?

Absolutely. Many Vietnam forex trading enthusiasts work around their full-time jobs. The post-work hours — especially 7 PM to 10 PM — are ideal for this group. These hours align with peak overlap between London and New York, and the liquidity allows for short-term trades or event-based plays without needing all-day screen time.

8. Is it possible to build a long-term routine around Vietnam’s forex trading hours?

Yes. In fact, many experienced traders argue that local time consistency beats chasing global news. By sticking to a well-defined daily window, your body adapts, your focus sharpens, and your entries become more deliberate. The key is to find a window that fits your lifestyle — and commit to showing up consistently during that time.

Closing Thought: Strategy Isn’t Just About Charts — It’s Also About Time

Understanding forex time zones and choosing your best trading hours is as strategic as any technical setup. It’s not about staying up all night — it’s about being present when it counts. For traders across Vietnam and Asia, success often lies in mastering one thing: time, well-spent.