What Does the Rupiah Forecast 2025 Tell Us So Far?

The Rupiah Forecast 2025 reflects growing tension between a cautious global economy and Indonesia’s own development momentum. After years of navigating shocks — from pandemic disruptions to fluctuating commodity cycles — Indonesia’s financial markets are now entering a new chapter marked by both uncertainty and cautious hope. The Indonesian Rupiah (IDR), like many emerging market currencies, is sensitive to international capital flows, interest rate shifts, and investor sentiment. In 2025, these variables are especially volatile. Global demand is uneven, central banks are divided on rate policy, and geopolitical risk continues to cast long shadows. While the IDR has weathered previous headwinds, its 2025 trajectory will depend on how effectively Indonesia maintains economic credibility while adapting to external pressures that are outside its control.

Rupiah Forecast 2025: What Are the Main Threats to the Rupiah This Year?

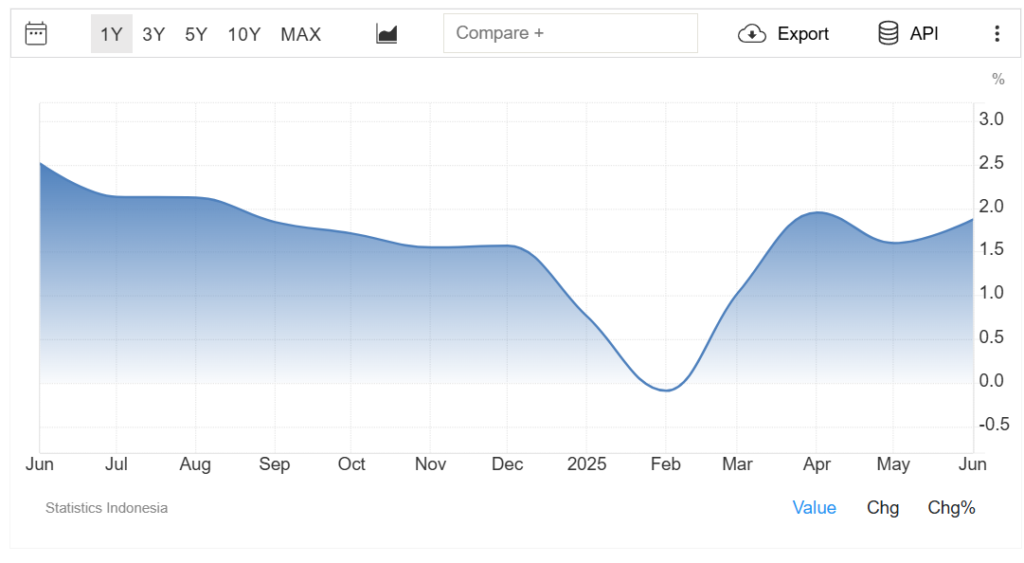

Source: TradingEconomics

The list of threats influencing the Rupiah forecast 2025 includes several well-known global and domestic issues, but their convergence makes this year particularly challenging. The biggest concern lies in the strength of the U.S. dollar, which could remain elevated if the Federal Reserve keeps interest rates higher for longer. In that case, investors may prefer U.S. bonds over emerging market assets, triggering capital outflows from countries like Indonesia. At home, Indonesia must manage inflation, maintain a healthy trade balance, and avoid any political turbulence that might spook markets. Other risks include potential declines in commodity prices — particularly palm oil and coal — or unexpected shocks from China’s slowing growth, which would affect exports. In short, even if domestic policies remain sound, external volatility can still shake the IDR.

Rupiah Forecast 2025: Is There Potential for the Rupiah to Strengthen?

Source: Bloomberg

While risks dominate the conversation, there is still room for the Rupiah to strengthen in 2025, especially if a few key trends align in Indonesia’s favor. For starters, if the Federal Reserve pivots toward cutting rates and global investors begin reallocating capital toward higher-yielding emerging market assets, the Rupiah could benefit. Additionally, Indonesia’s ongoing focus on macroeconomic stability — including measured fiscal management and responsible monetary policy — could enhance investor trust. Trade performance will also be critical. If exports remain robust and foreign direct investment holds steady, the IDR could find the support it needs to avoid major depreciation. The road to a stronger currency won’t be smooth, but it’s not entirely out of reach — assuming both internal and external conditions cooperate.

How Is the Broader Economy Supporting the Forecast?

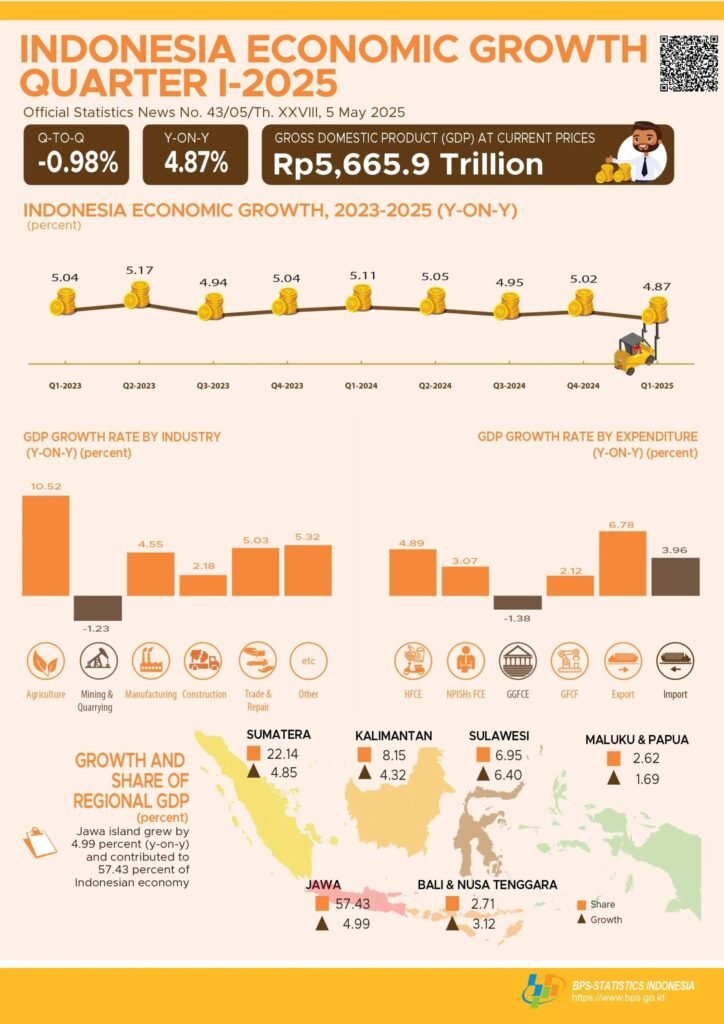

Source: BPS- Statistic Indonesia

The health of the Indonesia economy forms the backbone of any IDR outlook, and in 2025, it offers a mixed but cautiously optimistic picture. Indonesia has continued to post steady growth, driven by infrastructure expansion, rising consumer activity, and a maturing digital sector. These domestic strengths give the country a degree of insulation against external volatility. However, that buffer has limits. Indonesia remains reliant on commodity exports, and any softening in global prices — or a drop in demand from major trade partners — could narrow its trade surplus and weigh on the Rupiah. Additionally, large capital projects must be managed carefully to avoid fiscal slippage. If the government can keep debt under control while supporting private sector growth, it may offer a stable platform for the IDR to perform more consistently through the rest of the year.

What Stance Is Bank Indonesia Likely to Take?

Source: DATAINDONESIA

Central bank behavior is central to the Bank Indonesia currency forecast 2025, and so far, the institution has signaled that it remains committed to balancing inflation control with exchange rate stability. In recent months, Bank Indonesia has taken a more data-dependent approach, reacting to both domestic trends and global rate cycles. If inflation remains manageable and external pressures ease, the bank may have more room to support growth-oriented measures — including modest rate adjustments. However, should global shocks arise, the priority may quickly return to defending the Rupiah through tighter policy or direct FX market intervention. Market observers will be looking for clarity, consistency, and coordination — all of which could provide reassurance and moderate speculation-driven volatility in the currency market.

What Global Events Could Reshape the Forecast?

The direction of the Rupiah forecast 2025 is not just about numbers — it’s also shaped by broader geopolitical and economic dynamics. A few key factors will play an outsized role. First, the strength and timing of global recovery will matter: slower-than-expected growth in the U.S., China, or the EU could dampen trade and investment flows to Indonesia. Second, energy prices remain a wild card. Any instability in oil-producing regions or global shipping routes could send fuel prices higher, complicating inflation control in Indonesia. Third, political risk in neighboring ASEAN countries or in other emerging markets could cause risk contagion, affecting investor behavior even if Indonesia itself remains relatively stable. For the IDR, staying on course may mean managing not just policy — but perception.

Where Does the Rupiah Stand Among EM Currencies?

From a regional lens, the emerging market currencies outlook 2025 positions the Rupiah as relatively steady but not immune to volatility. Compared to more fragile currencies in regions dealing with debt crises or high inflation, the IDR looks better managed and less exposed. Still, it often moves with broader emerging market sentiment, meaning that any risk-off episode could pull it down regardless of Indonesia’s domestic fundamentals. To remain competitive, Indonesia will need to stay proactive — whether by communicating clearly with markets, offering attractive investment policies, or preserving the credibility of its financial institutions. These factors may not show up on the front page, but they shape how the IDR is valued around the world.

How Can Investors Respond to the 2025 Landscape?

For investors seeking exposure to the Indonesian market, the best strategy for Rupiah investment 2025 involves balancing opportunity with caution. This means factoring in short-term fluctuations while focusing on longer-term trends. Currency-hedged instruments, flexible equity positions, or well-timed entries into the bond market may all offer ways to mitigate risk. It’s also wise to keep an eye on potential policy shifts — whether from Bank Indonesia or in fiscal matters — as these can affect investor sentiment and capital movement. Patience, diversified positioning, and a clear understanding of external risk will all be essential for those hoping to navigate the 2025 IDR landscape successfully.

Final Thought: What Will Shape the Rupiah in the Months Ahead?

In summary, the Rupiah forecast 2025 remains a moving target, pulled by competing forces at home and abroad. While Indonesia continues to display macroeconomic stability and a maturing financial sector, its currency will still be shaped by decisions in Washington, price trends in global commodities, and investor sentiment across the broader emerging market space. If policymakers remain focused, communication stays clear, and external conditions don’t deteriorate sharply, the Rupiah may chart a steady — if cautious — path forward. But as always, adaptability and timely response will be key to managing what is never a straight line in currency markets.