The conversation around Web3 users vs traditional earners continues to grow louder, as more people explore non-traditional financial ecosystems. While one group earns and spends through crypto, DeFi platforms, and digital assets, the other follows tried-and-tested methods like budgeting, fixed savings, and long-term financial planning.

But who really spends smarter in 2025? The answer isn’t as clear-cut as it seems—and understanding both approaches reveals a lot about what smart money management looks like in today’s world.

Defining Smart Spending in Today’s Economy

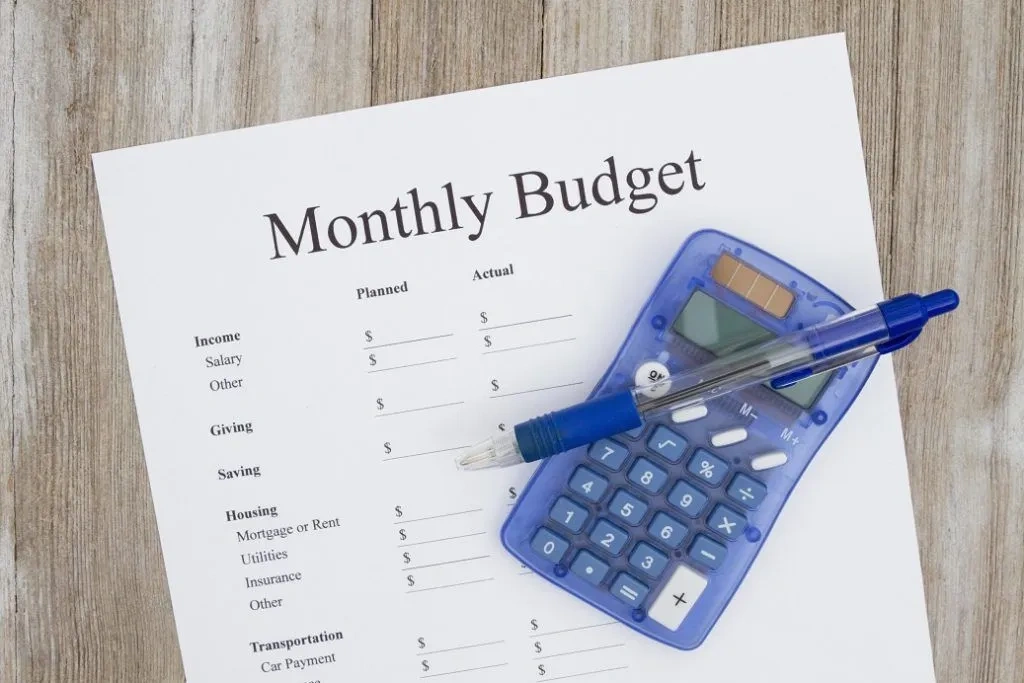

Before comparing the two camps, it’s important to define “smart spending.” Traditionally, this means:

- Living within your means

- Budgeting consistently

- Saving for the future (retirement, emergencies)

- Avoiding unnecessary debt

However, the Web3 perspective often redefines smart spending as:

- Generating passive income through staking or liquidity pools

- Taking calculated risks for high-yield returns

- Investing in digital assets like NFTs and DAOs

- Moving funds freely across decentralized platforms

What’s clear is that “smart” has become subjective, shaped by new tools, digital opportunities, and individual financial goals.

Mindset Differences: Stability vs Agility

Web3 Users tend to treat money as dynamic and borderless. They’re comfortable with volatility, often viewing it as part of the game. Their spending behavior is heavily influenced by:

- Market trends and community signals

- Opportunities in DeFi and token economies

- A preference for digital-first experiences and tech access

On the other hand, Traditional Earners prioritize stability and predictability. Their decisions are often based on long-term goals, supported by financial advisors or structured saving plans. Key characteristics include:

- Steady income through employment

- Emphasis on security (e.g., insurance, fixed deposits)

- Prioritizing family, mortgages, and retirement

Analyzing Spending Behavior

A recent fintech survey shows that 40% of Web3 users experienced portfolio swings of over 30% in just one quarter. This speaks to high volatility—but also the potential for exponential gains.

By contrast, traditional earners maintain lower volatility and steadier financial discipline. Their expenses typically fall within planned budgets, and they are less likely to engage in speculative spending.

| Category | Web3 Users | Traditional Earners |

|---|---|---|

| Financial Risk | High (crypto, NFTs, DeFi) | Low (fixed deposits, index funds) |

| Spending Focus | Tech, digital assets, experiences | Essentials, utilities, long-term goals |

| Learning Curve | Steep but fast | Gradual and structured |

| Volatility | High | Low |

| Time Horizon | Short to medium-term | Long-term |

Learning from Mistakes: Adaptation Speeds Matter

A notable strength of Web3 users is their ability to learn quickly. With frequent market shifts, many are forced to understand trading patterns, tokenomics, and risk management faster than the average investor.

Traditional earners may take longer to adopt new financial tools, often due to caution or lack of exposure. However, this can shield them from loss and provide emotional and financial stability.

The difference in adaptation speed highlights how each group approaches uncertainty: one embraces it; the other mitigates it.

The Verdict: Web3 vs traditional- Is One Smarter Than the Other?

There’s no universal answer. Smart spending is contextual. It depends on your goals, risk tolerance, financial literacy, and even lifestyle preferences.

- If your goal is long-term security, traditional strategies may serve you best.

- If you aim for high-reward agility, Web3 could be your playground—with caution.

The most effective financial approach today may be a hybrid: structured savings with a portion of digital investments. This offers the best of both worlds—security and growth potential.

Conclusion: Web3 vs traditional- Rethinking “Smart” in Spending

Rather than asking who spends smarter, a better question in 2025 might be: “How can I make both systems work for me?” Financial success now favors those who understand multiple approaches—and use each strategically.

In an age of constant innovation, adaptability and literacy—not loyalty to one system—may be the new markers of financial intelligence.

Relevant News: HERE