Trading Journal Indonesia: In Indonesia’s rapidly evolving trading environment, more and more traders are realizing that having a well-maintained trading journal is not just a bonus — it’s a necessity. Whether you trade forex, stocks, or cryptocurrencies, a trading journal helps you document every position you take. More importantly, it gives you insight into your behavior, strategy, and risk management. Rather than relying on memory or emotion, your journal becomes a personal database to reflect on what works and what doesn’t. Over time, this habit sharpens your decision-making and builds consistency — two pillars of trading success.

Define the Purpose of Your Trading Journal

Before setting up a trading journal, it’s important to understand why you’re doing it. Some traders use it to evaluate performance and calculate statistics such as win rate or average return. Others want to control emotional decisions, like revenge trading or panic selling. Some seek better discipline, while many use it to optimize specific strategies. Knowing your purpose helps you focus on the most relevant information. For example, if your goal is to track your emotional responses during market volatility, your journal should include emotional state and confidence levels in each entry.

Choose Your Format: Digital or Manual?

Source: Dribbble

The right journal format depends on your trading style and personal preference. Excel and Google Sheets are popular among Indonesian traders due to their flexibility and accessibility. You can add formulas to calculate metrics automatically and sort trades based on strategy or outcome. Some prefer dedicated journaling apps like Edgewonk or TraderSync, which offer more structure and performance analytics. If you’re more reflective, a physical notebook or journaling app like Notion can help capture the emotional and strategic context. Crypto traders may benefit from tools like CoinMarketMan, especially with the fast-moving 24/7 nature of crypto markets.

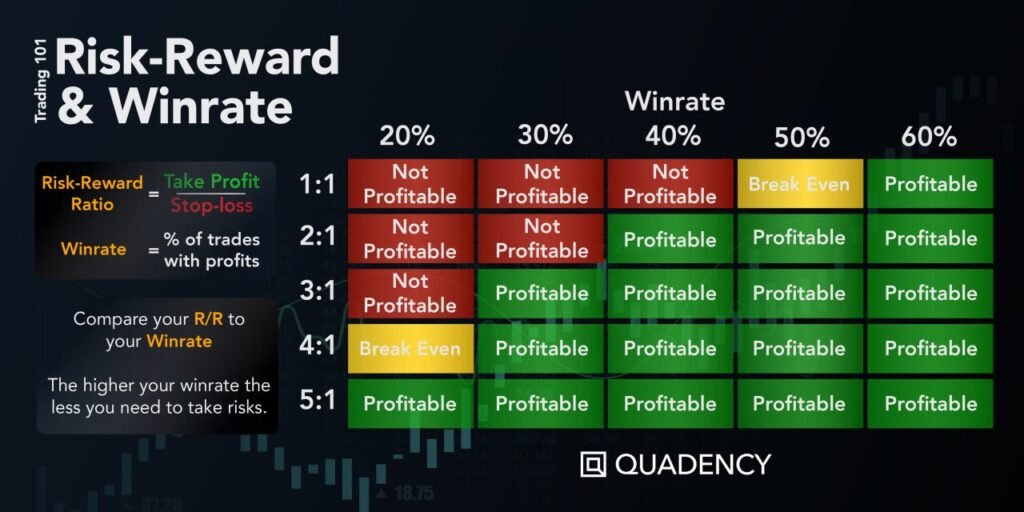

What to Include in a Trading Journal

Source: Linkedin

A good trading journal goes far beyond just listing entries and exits. It should include the trading date and time, asset traded (e.g., EUR/USD, BTC/USDT), whether you went long or short, and your entry and exit price. Other crucial elements are your stop-loss and take-profit levels, position size, the strategy used, and market conditions. Don’t forget to record your emotions — were you calm, overconfident, or hesitant? Finally, document the trade outcome (profit/loss, win/loss ratio) and any post-trade thoughts. These insights will prove invaluable during your reviews.

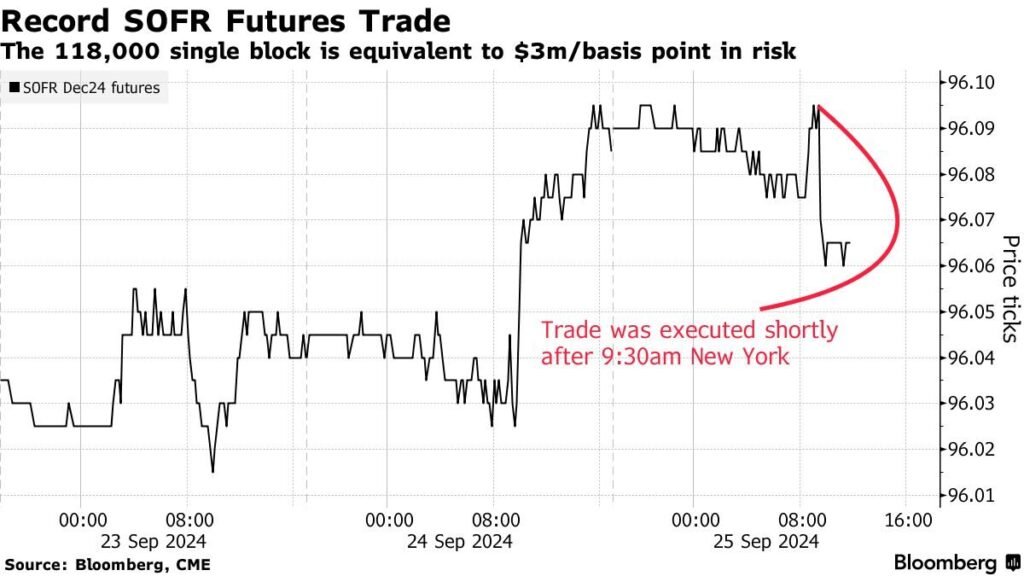

Record Trades Immediately After Execution

Source: Bloomberg

To maintain an accurate trading journal, make it a habit to record your trades right after they happen. Delaying the process could mean forgetting small but important details — such as why you took the trade, your emotional state, or last-minute news that influenced your decision. Keep your journal open during your trading sessions. That way, you can log information as you go. Many successful traders also take screenshots of their charts before and after the trade to visually review setups and outcomes later.

Review Your Journal Regularly

Source: Babypips

The real power of a trading journal lies in reviewing it regularly. At the end of each week or month, block out time to assess your trading behavior and performance. Identify which strategies yield consistent results, and which ones fail repeatedly. Check your risk management — are you following your rules? Are you overtrading or cutting winners too early? Use Excel charts or pivot tables to visualize performance. Patterns will start to emerge, helping you correct weaknesses and amplify strengths. Without review, a journal is just a record — with review, it’s a roadmap.

Use Templates to Save Time and Stay Consistent

Source: Notion

For those just starting out, using a pre-made template can save hours of setup and bring more structure to your journal. Some templates are designed specifically for forex traders, tracking pip values and swap rates. Others cater to crypto traders, including fields for slippage and network fees. Multi-asset templates are also available for traders who dabble in forex, stocks, and crypto. Popular templates like the “Leak Finder Journal” help isolate flaws in execution or strategy, while full-featured journals like “Financial Tech Wiz” come with automated analysis and S&P500 benchmarking. Pick a format, and personalize it over time.

Trading Journal Indonesia: Special Considerations for Crypto Traders in Indonesia

Source: Pintu

Crypto markets operate 24/7, often with extreme volatility and higher risk. As an Indonesian crypto trader, your journal should adapt to these challenges. Besides the usual data, include the type of market (spot, margin, or futures), trading fees, slippage, and any major news or macro events influencing your decisions. Since crypto trades can happen at any hour, it’s especially important to note your energy and mental state — were you tired or rushing during the trade? Some Indonesian traders use platforms like Pintu or CoinMarketMan with journal integration to track performance in real time.

Trading Journal Indonesia: Build the Habit — Not Just the File

Source: Filling The Jar

The hardest part of journaling isn’t starting — it’s sticking to it. To make it a lasting habit, embed journaling into your trading workflow. Set a recurring alarm to log trades after each session. Use color coding in your spreadsheet to make analysis faster. If you use screenshots, organize them in folders by week or strategy. Set a monthly review date on your calendar, just like you would for bills or appointments. Journaling should feel as routine as checking the charts. Over time, this practice builds consistency and maturity in your trading mindset.

Conclusion: Trading Journal Indonesia- Your Journal, Your Edge

In summary, a well-maintained Trading Journal Indonesia is more than a tracker — it’s your personal trading assistant. It guides you through your wins, helps you reflect on your losses, and keeps your emotions in check. Whether you’re just starting out or looking to scale your trading system, journaling is a low-cost, high-reward habit. The key is to keep it simple at first and let it evolve with you. Data is power — and when you hold your own trading data in your hands, you’re no longer guessing. You’re improving.