In financial circles, one word has been echoing with unusual consistency: transparency. Investors, fund managers, and even casual traders are asking the same question — how can trust and oversight be built into managed accounts without stifling performance?

It is against this backdrop that Prorex PAMM has found itself a recurring topic of conversation. More than just a trading feature, the system has been described as a framework that attempts to rebalance the relationship between broker, trader, and investor. Instead of being framed solely as technology, the Prorex PAMM system has been positioned by analysts as a story of trust, control, and adaptability in the modern era of managed accounts.

What Experts See in Prorex PAMM and Control

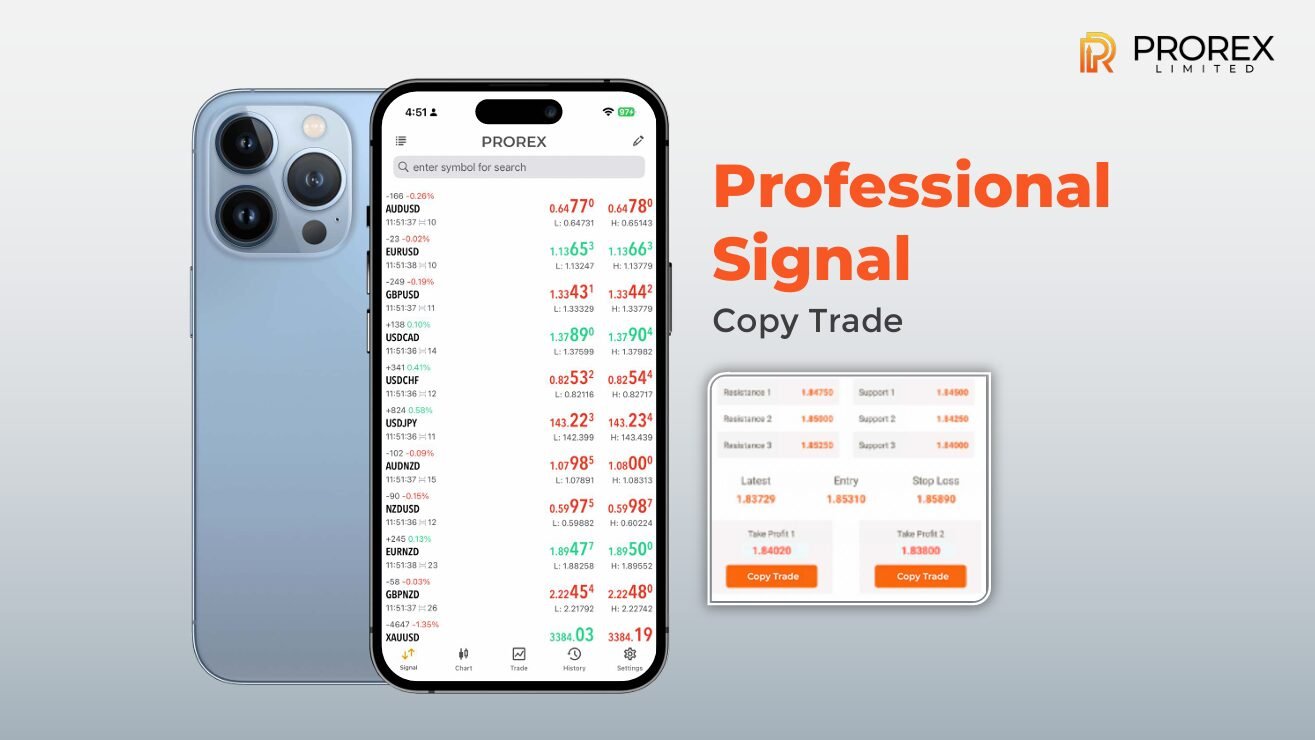

For decades, one of the sharpest criticisms of managed accounts has been the sense of investors “handing over” too much power. Oversight often disappeared once capital was allocated. With the Prorex PAMM trader model, however, analysts highlight the way real-time reporting, customizable allocation, and tools like Prorex AI trading and Expert Advisors are rewriting that narrative.

As one industry analyst noted, “It’s less about giving up control and more about gaining visibility.” Transparency becomes tangible when investors can see how a Prorex PAMM account is performing, configure allocations, or even integrate strategies through the Prorex indicator suite.

And while structure and oversight matter, conditions matter too. The consistently highlighted advantage is the Prorex low spread environment — a feature that appeals not only to institutional managers but also to active traders who run strategies on copy trading platforms or within a multi account manager (MAM) module.

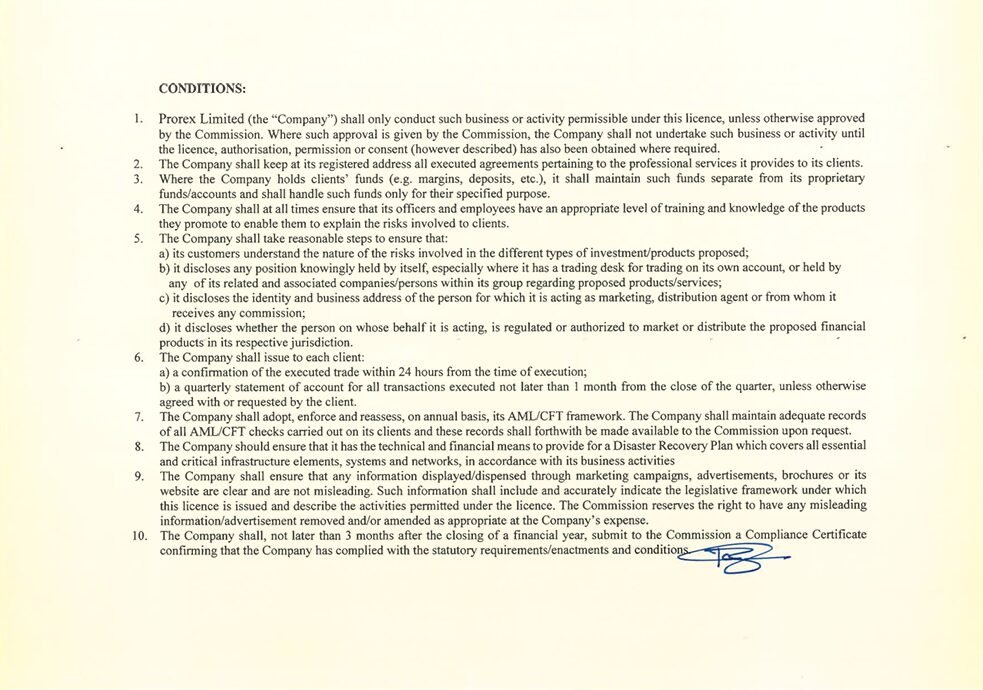

Prorex Limited, Licensing, and Why It Matters

Prorex Limited operates as a regulated brokerage firm and actively highlights its licensing credentials in professional discussions. Licensing isn’t just legal paperwork; it is the bedrock of investor confidence. In volatile markets, the difference between a Prorex broker and an unregulated alternative is not cosmetic. It shapes how resilient the platform is to shocks, compliance checks, and evolving international financial standards.

Licenses support investor protection, align practices with global oversight, and separate companies that can sustain trust from those that may erode it. As one market columnist remarked, “The license is what makes a PAMM investment platform more than a trading gimmick. It’s what grounds the system in credibility.”

Within that framework, Prorex positions its revenue share program, free credit, and free bonus campaigns not as mere marketing hooks, but as clear demonstrations of adaptability — showing how the broker actively evolves with the demands of both traders and investors.

Why a Prorex PAMM Account Matters in 2025

Managed accounts in 2025 are not the same as those of ten years ago. The best PAMM broker in 2025 is expected to scale efficiently, operate transparently, and allow investors to customize their strategies freely. In this landscape, Prorex’s multi account manager (MAM) module stands out by actively managing multiple portfolios with precision. Configure performance fees, and deliver execution across markets with low latency.

For investors, this shift underscores an important point: a Prorex PAMM system isn’t an outdated model. It’s part of an evolving PAMM investment platform, increasingly aligned with diverse investor goals. Whether that’s a short-term allocation to a Prorex copy trade strategy or a long-term position built with Prorex PAMM trading tools. The minimum entry barrier has also become part of the conversation. With the Prorex PAMM minimum deposit making managed account access less exclusive than in previous cycles.

A Columnist’s Take on Prorex PAMM

In conversations with fund managers and analysts, three recurring ideas surface: trust, oversight, and adaptability. Investors notice Prorex PAMM because it actively merges regulatory strength with flexible technology, delivering licensed credibility alongside AI-driven scalability.

In a market where confidence is the real currency. The system illustrates how managed accounts can evolve without losing sight of investor empowerment. Looking ahead, it is this balance — between transparency and innovation. That will determine which brokers establish themselves as leaders in the next wave of PAMM investment platforms. It blends trust with innovation. Qualities that investors are likely to value even more in the years ahead.

【 Prorex Limited 】

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia