MACD RSI for Forex Indonesia: In the fast-moving world of forex trading, Indonesian traders often seek clarity amid the noise. Technical indicators offer that — a structured way to analyze price movement and momentum when market behavior becomes hard to read. Especially in an environment where local economic policy, commodity prices, and global factors can influence the IDR, these tools help filter signal from noise. Indicators such as MACD RSI for Forex Indonesia provide an extra layer of perspective, allowing traders to base decisions not just on market headlines but on actual price behavior. This blend of structure and insight makes them highly valued across different trading styles — whether you’re a short-term scalper or a longer-term trend follower.

MACD RSI for Forex Indonesia: What Role Does MACD Play in Indonesian Forex Trading?

MACD, or Moving Average Convergence Divergence, is designed to track the relationship between short- and long-term price trends. It uses two exponential moving averages (EMAs) to identify momentum changes, often signaling when a trend is gaining or losing strength. In Indonesia’s forex scene, traders frequently turn to MACD during times of potential market shifts — such as before or after a Bank Indonesia announcement, or in reaction to global rate hikes. A crossover of the MACD line above the signal line typically indicates rising bullish momentum, while the opposite suggests possible downward pressure. For traders watching pairs like USD/IDR or EUR/IDR, MACD is a practical tool to confirm whether a trend is taking hold or weakening after a sudden move triggered by external factors.

MACD RSI for Forex Indonesia: How Do Indonesian Traders Use RSI in Their Analysis?

Source: TABTRADER

The Relative Strength Index (RSI) is a momentum oscillator that helps traders assess whether a currency is being overbought or oversold. It’s especially helpful in a market like Indonesia’s, where prices can react quickly to local news, policy signals, or global macro events. RSI operates on a 0–100 scale and tends to generate key trading signals when it crosses over 70 or below 30. In practice, Indonesian traders often use RSI as a sanity check — confirming whether recent price movement is supported by strength, or possibly exaggerated by short-term volatility. RSI is also frequently referenced during flat markets to identify buildup before breakouts. When paired with MACD, it offers a complementary view, confirming whether momentum aligns with the broader trend.

MACD RSI for Forex Indonesia: Why Combine MACD and RSI in Forex Trading?

Both MACD and RSI have their individual strengths, but used together, they offer deeper market context. MACD identifies the trend and its strength, while RSI gauges whether momentum is overextended. Many Indonesian traders use the two in tandem to avoid premature entries or exits. For instance, if MACD suggests the beginning of a bullish trend but RSI is already in overbought territory, a trader may wait for a better entry. Similarly, if both indicators are showing bearish divergence, it may strengthen the case for a short position. This layered approach reduces risk by confirming signals from more than one angle — especially useful in a market where volatility can spike unexpectedly due to shifts in commodity prices or policy talk.

MACD RSI for Forex Indonesia: How Do Bollinger Bands Fit Into the Strategy for Indonesian Traders?

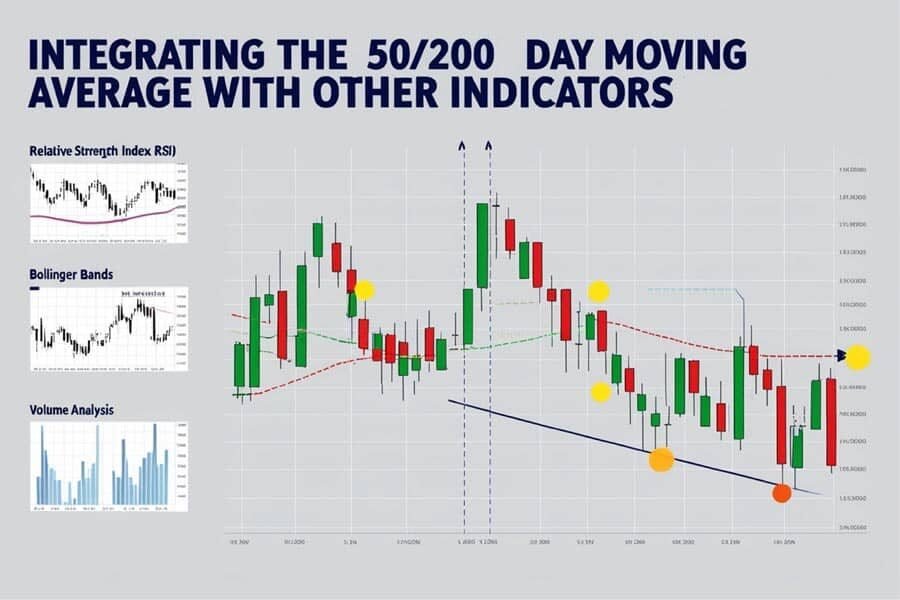

Bollinger Bands provide a dynamic view of price volatility and potential reversal zones. They consist of a moving average flanked by two standard deviation bands that expand and contract with market activity. In the Indonesian forex landscape, where unexpected news and external shocks can trigger sharp moves, Bollinger Bands help traders visually assess whether the price is pushing into extreme territory. When price nears the upper band with high RSI, it might signal an overstretched rally. Conversely, a move near the lower band with falling MACD may hint at building bearish momentum. Indonesian traders often use Bollinger Band “squeezes” to anticipate breakout potential, using MACD and RSI as confirmation tools to avoid false alarms.

What’s the Role of Moving Averages in Indonesian Trading Habits?

Source: OPOfinance

Moving averages — whether simple (SMA) or exponential (EMA) — help traders smooth out price noise and better identify long-term direction. In Indonesia’s forex scene, they’re particularly useful when markets shift gradually rather than sharply. For example, a crossover between short- and long-term EMAs may signal a change in trend, especially when supported by a rising MACD line or RSI moving through the 50 mark. Traders tracking currency pairs impacted by global commodity prices or interest rate decisions — such as AUD/IDR — use moving averages to identify zones of dynamic support or resistance. Combining these with MACD and RSI enhances reliability, helping traders spot setups that may not be visible with a single tool alone.

How Does the Stochastic Oscillator Enhance Technical Analysis?

Source: Pluang

The stochastic oscillator offers traders a snapshot of price momentum relative to a recent range, helping identify possible reversal points. While similar to RSI, stochastic is often faster and more sensitive, making it ideal for short-term Indonesian traders operating in volatile sessions. It produces two lines — %K and %D — that show potential turning points when they cross above 80 or below 20. Many traders in Indonesia find it particularly useful for confirming the end of a trend or timing a breakout move. For instance, a stochastic crossover in the oversold area, backed by a MACD shift and rising RSI, may signal a strong potential buy. When used thoughtfully, it can sharpen trade entries and exits, especially in combination with MACD RSI strategies.

What Mistakes Should Indonesian Traders Avoid with Indicators?

Technical indicators are tools, not guarantees. One common mistake is to rely too heavily on a single signal or ignore broader market conditions. For instance, a MACD crossover might look promising, but if it occurs during low liquidity hours or against a strong economic trend, the signal may not hold. Indonesian traders sometimes also overlook the context behind price movement — focusing only on charts without considering news from Bank Indonesia or external policy updates that directly affect the rupiah. Over-trading based on indicator noise or using too many overlapping tools can also create confusion. The best practice is to use MACD RSI for Forex Indonesia as part of a bigger picture — one that includes economic awareness, proper risk management, and emotional discipline.

Are MACD and RSI Still Useful Tools in 2025?

Despite the rise of new trading platforms and algorithmic models, MACD RSI for Forex Indonesia remain as valuable as ever in 2025. Their strength lies in their adaptability — whether the market is calm, trending, or volatile. For Indonesian traders, these tools help maintain a consistent decision-making framework in the face of often unpredictable news cycles and currency reactions. They simplify what can feel like complex price behavior and provide visual checkpoints before entering or exiting a trade. When combined with broader market understanding and other support tools like Bollinger Bands or moving averages, MACD and RSI continue to serve as trusted allies for traders navigating the evolving forex space in Indonesia.