What is gold tokenization and why is it important for Indonesia in 2025?

Gold tokenization Indonesia is the process of turning real, physical gold into digital tokens recorded on a blockchain. Each token is backed by an equivalent value of gold held in trusted, secure vaults. In 2025, this process has become increasingly important for Indonesians as both global financial instability and domestic inflation push investors toward assets that are both stable and accessible. Indonesia, with its long-standing cultural and economic relationship with gold, is a natural fit for tokenized gold solutions. The digitization of this traditional asset means that people from all economic backgrounds—whether in Jakarta or rural Sumatra—can buy and hold gold in small fractions using only a mobile phone. It democratizes ownership and brings one of Indonesia’s most valued assets into the future of digital finance.

How does tokenized gold work within the Web3 environment in 2025?

In 2025, the Web3 ecosystem is more mature, with greater public awareness and a wider range of decentralized financial tools. Tokenized gold fits into this landscape by acting as a stable, blockchain-based asset that users can own, trade, and integrate into smart contract systems. Once physical gold is securely stored, blockchain protocols issue a matching amount of digital tokens—each representing real-world value. These tokens are fully portable, meaning they can move across wallets, decentralized exchanges, and even lending platforms. In the context of gold tokenization Indonesia, these tokens are giving users newfound control over their wealth, allowing them to participate in the broader digital economy while holding a historically trusted form of value. Gold, once kept in safes and jewelry boxes, is now operating alongside cryptocurrencies in an ecosystem defined by automation, transparency, and global accessibility.

What are the key benefits of gold tokenization for Indonesian investors in 2025?

The benefits of tokenized gold for investors in Indonesia have expanded significantly in 2025. The first major advantage is accessibility: gold is no longer restricted to those who can afford full grams or bars. Tokenized gold enables micro-investing—users can purchase gold worth just a few thousand rupiah. This aligns perfectly with the economic diversity of Indonesia’s population. Second, liquidity has improved. Gold tokens can be traded or converted at any time, without the delays and fees associated with traditional gold dealers. Third, tokenized gold now interacts with decentralized finance, offering possibilities such as staking or collateralized lending. These features turn passive gold holdings into yield-generating assets. In a country where many young people are embracing mobile-first investment platforms, the convergence of gold and Web3 is creating a vibrant new market for secure, practical, and flexible financial participation.

Is gold tokenization safe and regulated in Indonesia in 2025?

The question of safety and regulation is crucial as gold tokenization Indonesia enters a more mainstream phase. By 2025, regulatory bodies such as BAPPEBTI have made considerable progress in addressing digital commodities, including gold-backed tokens. While the full legal infrastructure is still evolving, platforms now face clearer compliance guidelines. Trusted providers operate under government oversight and publish third-party audits verifying their gold reserves. In addition, blockchain protocols have improved in terms of smart contract safety, auditability, and user transparency. The smart contracts that govern tokenized gold transactions are now often open source and subject to external review. Although risks remain—as with any financial product—Indonesian investors today have more tools to evaluate and choose safe, compliant gold token platforms than they did just a few years ago. This regulatory evolution is helping build public confidence and encouraging wider adoption.

How does tokenized gold compare to digital gold offered by banks or fintech apps?

Source: Investopedia

At first glance, digital gold from banks and gold tokenization Indonesia may seem similar, but their mechanics and user freedom differ significantly. Digital gold offered by banks is often kept within closed systems; users can view their balance and sell it back to the provider, but cannot move or use it outside the issuing app. There is limited transparency, and the provider retains full custody of the asset. Tokenized gold, on the other hand, operates on public blockchains, meaning users hold their tokens directly in their wallets. They can transfer them, use them in DeFi protocols, or store them in cold storage for added security. Tokenized gold offers greater interoperability, traceability, and user control—features that align with the broader goals of Web3. In 2025, more Indonesians are beginning to realize the freedom that comes with blockchain-backed gold compared to centralized, app-locked digital gold.

Can investors in Indonesia earn returns on tokenized gold?

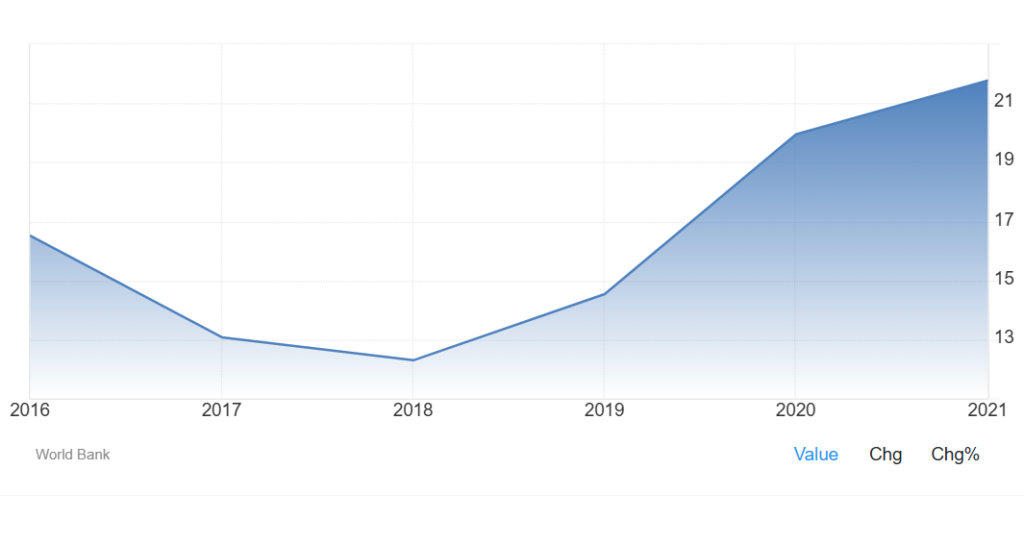

Source: Trading Economics

Yes, and this represents one of the most transformative shifts in how Indonesians think about gold in 2025. With tokenized gold in decentralized finance, ownership is no longer passive. Today, holders of gold tokens can access a variety of decentralized platforms that allow them to lend their tokens, stake them for rewards, or use them as collateral for crypto loans. These mechanisms offer the potential for passive income on top of gold’s intrinsic value preservation. While traditional gold sits idle in storage, tokenized gold can earn yields—often automatically through smart contracts. For Indonesia’s emerging class of digital investors, this represents a compelling reason to shift toward Web3-based gold assets. However, these returns come with risk, and users must weigh security, platform reputation, and smart contract stability when making decisions. The tools are now in place, but financial literacy remains key to responsible participation.

What is the long-term outlook for gold tokenization in Indonesia?

Source: itchronicles

The outlook for gold tokenization Indonesia is promising, particularly as both technology and regulation evolve in parallel. By 2025, Indonesia has seen substantial growth in crypto adoption, mobile banking, and Web3 experimentation. With government support for innovation and increased public understanding of blockchain, tokenized gold is likely to play a larger role in everyday finance. Future use cases may include tokenized gold as a savings tool in national e-wallets, integration into Islamic finance products, or cross-border payments between ASEAN nations. The merging of physical asset value with digital utility also has implications for remittances, inheritance planning, and microloans. As more platforms build real-world use cases and regulators clarify their stance, gold tokenization could become a standard offering in Indonesia’s fintech landscape. It’s not just a trend—it’s part of the country’s broader economic digitalization strategy, grounded in local values and global possibilities.

Conclusion: In 2025, Gold Tokenization in Indonesia Is Redefining Financial Access

By 2025, gold tokenization Indonesia is no longer just a tech experiment—it’s a growing pillar of financial inclusion, asset flexibility, and decentralized ownership. Combining the familiarity and cultural value of gold with the global capabilities of blockchain, tokenized gold is allowing Indonesians to rethink how they save, invest, and interact with wealth. Whether used as a hedge, a tradeable asset, or a DeFi tool, tokenized gold is proving that tradition and innovation can coexist. As regulation strengthens and awareness expands, Indonesia is well-positioned to become a regional leader in the adoption of digital gold solutions. The transformation is already underway—and it’s reshaping the meaning of value for millions of people across the archipelago.