1. What’s the current state of gold prices in Indonesia?

As we move through 2025, gold prices in Indonesia are holding strong — but they’re also unpredictable. The gold price forecast Indonesia analysts are watching closely has been shifting with inflation chatter, economic data, and currency fluctuations.

Right now, local prices are high by historical standards, but haven’t broken out wildly. Many Indonesians are taking a “wait and watch” approach before making major investment moves.

2. Why are gold prices in Indonesia acting the way they are?

It’s not one thing — it’s a mix. Think of it as a recipe:

- Rupiah volatility: When the local currency drops, imported gold gets pricier.

- Central bank moves: Bank Indonesia and the U.S. Fed both impact investor behavior.

- Inflation pressures: Investors often turn to gold to protect purchasing power.

- Unstable geopolitics: War zones, elections, trade wars — all of these push investors toward gold as a “safe bet.”

All those things together create a market that’s cautious, reactive, and occasionally unpredictable.

3. What are 2025 gold price projections for Indonesia?

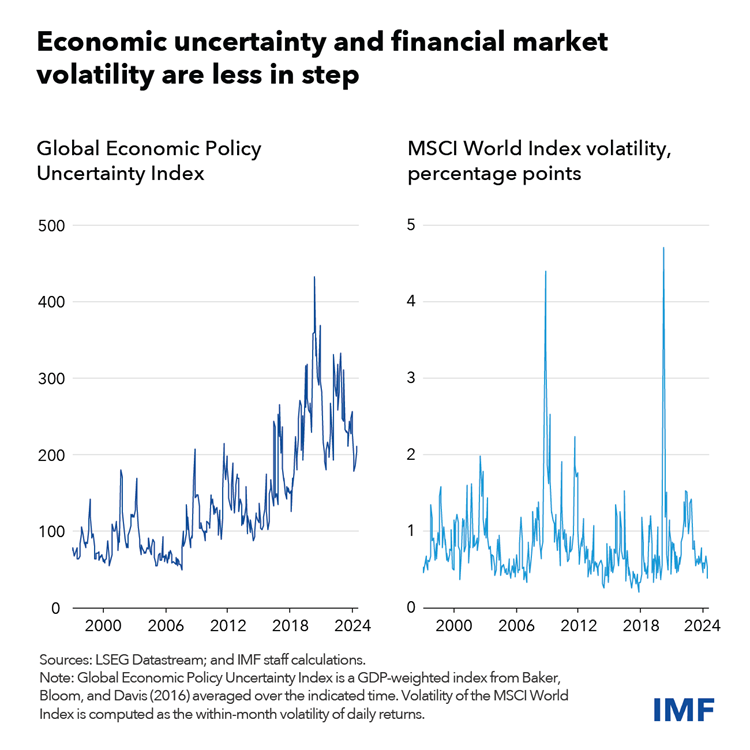

source: How High Economic Uncertainty May Threaten Global Financial Stability

This year’s forecasts are pretty split — but not extreme.

Optimists think prices could climb toward Rp 1,400,000 per gram by the end of the year, assuming demand stays firm and inflation remains sticky.

On the flip side, if rate hikes continue and global economies stabilize, prices might flatten or dip back toward Rp 1,100,000–1,200,000 range.

Overall, most experts agree that gold will probably stay in a higher-than-average band — but maybe not rocket to record highs.

4. Should Indonesian investors buy gold now or hold off?

Depends on your plan. If you’re in it for long-term savings or to guard against a weak rupiah, gold is still a good move.

But if you’re hoping for a quick win? Probably not ideal. Gold tends to rise slowly — and sometimes stalls for months.

Plus, buying physical gold in Indonesia means dealing with high markups, taxes, and resale limits. Consider digital gold or gold savings accounts as alternatives.

5. Gold price forecast Indonesia: What global factors could still shake the market?

Here are a few key things to keep your eye on:

- U.S. interest rates: Any sudden shift could strengthen the dollar and push gold down.

- China and India’s gold demand: These two giants move the needle globally.

- Energy prices: Higher oil prices often signal higher inflation — and gold loves that.

- Unexpected events: Think political instability, natural disasters, or new trade sanctions.

The gold market’s like a sponge — it soaks up news from everywhere, even if it’s not local.

6. Gold price forecast Indonesia: Where can Indonesians find accurate gold price updates?

Accuracy matters — especially when prices move daily.

Here’s where to check:

- Antam (Logam Mulia): Official prices for gold bars

- Pegadaian: Trusted for gold savings and buying

- Pluang, Bibit, or Tokopedia Emas: Digital options for younger investors

- CNBC Indonesia, Kontan, or Bisnis.com: Good for analysis and local context

Avoid relying on random WhatsApp forwards or outdated price charts — gold isn’t a guessing game.

7. Final thoughts: Is gold a smart move in 2025?

The gold price forecast Indonesia this year points to stable-to-slightly-increasing prices. No fireworks, but no freefall either.

If you’re building long-term wealth, gold still has its place — especially in uncertain times. But go in with realistic expectations. It’s a slow burn, not a lottery ticket.

Think of it as a piece of the puzzle — not your whole investment picture.