DeFi vs CeFi vs TradFi: Understanding the Evolution of Financial Systems

In today’s rapidly changing financial landscape, the terms DeFi, CeFi, and TradFi are becoming increasingly common. While they may sound like tech jargon, these terms represent the three main pillars of how money is managed, moved, and accessed in the modern world.

Each system offers a different model—shaped by control structures, risk profiles, and user experience. To make informed financial decisions, it’s important to understand what each system entails, where it shines, and where it falls short.

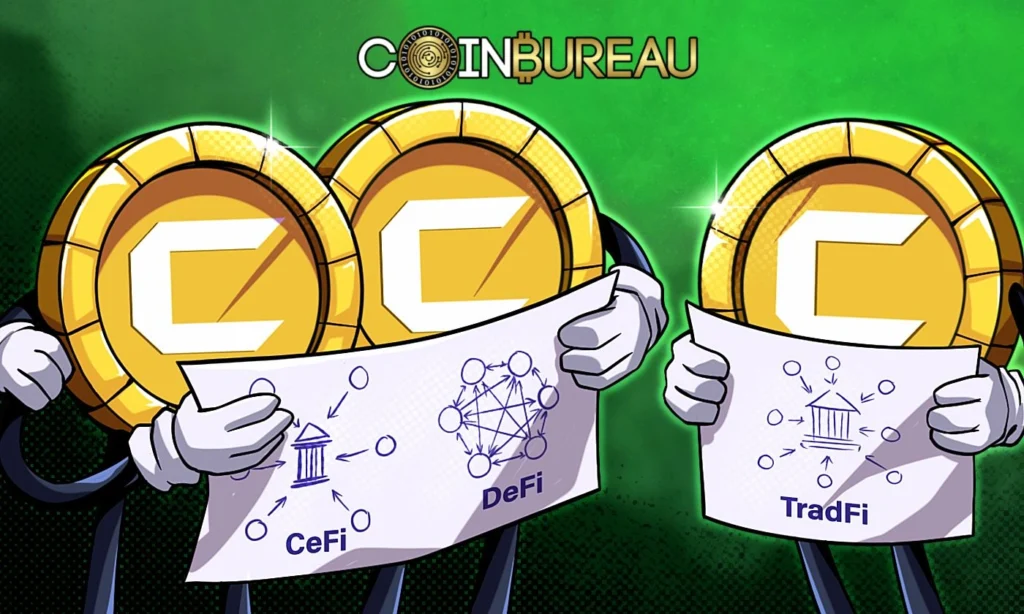

What Are DeFi, CeFi, and TradFi?

Let’s start by defining each term clearly:

- TradFi (Traditional Finance) refers to conventional financial institutions such as banks, credit unions, and stock markets. These entities are heavily regulated and have been foundational to the global economy for decades.

- CeFi (Centralized Finance) involves crypto-related financial services that operate under centralized structures. Examples include platforms like Coinbase, Binance, and Kraken. While they deal in digital assets, they manage user funds and services similarly to traditional banks.

- DeFi (Decentralized Finance) is a blockchain-based financial system that removes intermediaries. Through smart contracts and decentralized protocols, users interact directly with financial services, maintaining full custody of their assets.

The key differentiator across these models is control—who holds it, how much users have, and how trust is established.

Control, Trust & Custody: A Core Comparison

Here’s a breakdown of how each system handles three major concepts in finance: control, trust, and asset custody.

- TradFi relies on institutional trust. Banks and governments are gatekeepers, offering services like fraud protection, credit scores, and regulated transactions. However, this often comes with slower processes and limited access, especially in underbanked regions.

- CeFi brings crypto into a more structured environment. Users trust the platform (not the blockchain) to manage their keys, handle transactions, and ensure platform stability. While user experience is simplified, control remains largely centralized.

- DeFi offers a trustless environment, meaning trust is placed in code, not institutions or people. It provides full autonomy, but also demands personal responsibility. Losing a private key, for example, could mean permanent loss of assets.

Pros and Cons of DeFi vs CeFi vs TradFi

Each system has distinct advantages and limitations:

TradFi

Pros:

- Broad acceptance

- Regulated and insured

- Access to services like loans and credit history

Cons:

- Limited transparency

- Slower transaction times

- Often inaccessible to those without formal banking

CeFi

Pros:

- User-friendly interfaces

- On/off ramps to fiat currency

- Support and customer service

Cons:

- Custodial risk (you don’t control your keys)

- Vulnerability to platform failures or fraud

DeFi

Pros:

- Full asset ownership

- Global, 24/7 access

- Transparent, open-source protocols

Cons:

- High learning curve

- Prone to smart contract bugs and hacks

- No customer support or recourse

The Future: A Hybrid Financial Model?

Financial ecosystems are not evolving in isolation. Increasingly, we’re witnessing a convergence:

- Banks are exploring blockchain and digital assets to streamline operations.

- CeFi platforms are integrating DeFi offerings, such as yield farming and staking.

- DeFi protocols are building compliance tools, insurance products, and more accessible interfaces.

This hybrid approach suggests that the future may not be about choosing one system over the others, but rather understanding how each can coexist and complement the rest.

DeFi vs CeFi vs TradFi: Final Thoughts- Why This Knowledge Matters

Understanding the differences between DeFi, CeFi, and TradFi goes beyond buzzwords. It’s about recognizing how financial systems impact access, control, innovation, and risk.

While no system is flawless, being aware of the strengths and weaknesses of each enables individuals to make better decisions based on their needs, risk tolerance, and values.

Whether you’re using a banking app, trading on a centralized exchange, or exploring a decentralized lending protocol, knowing how the system works—and who controls it—is essential in today’s evolving economy.

And that’s the power of informed financial literacy.

Relevant News: HERE