During a recent discussion with investors and fund managers, one term kept resurfacing: Prorex Pamm Trader. Some saw it as a bridge between traditional portfolio management and digital trading platforms, while others viewed it as a practical entry point for those looking to participate in global markets without the stress of daily trade execution. In either case, it was clear that Prorex’s approach had carved out a distinctive place in the forex landscape.

A Conversation on Why Prorex Pamm Trader Stands Out

When asked why PAMM accounts are gaining traction, one manager explained that the model removes emotional decision-making from trading. “You still have exposure to the markets,” he said, “but with Prorex Pamm Trader, you know your funds are allocated proportionally and overseen by professionals using structured methods.”

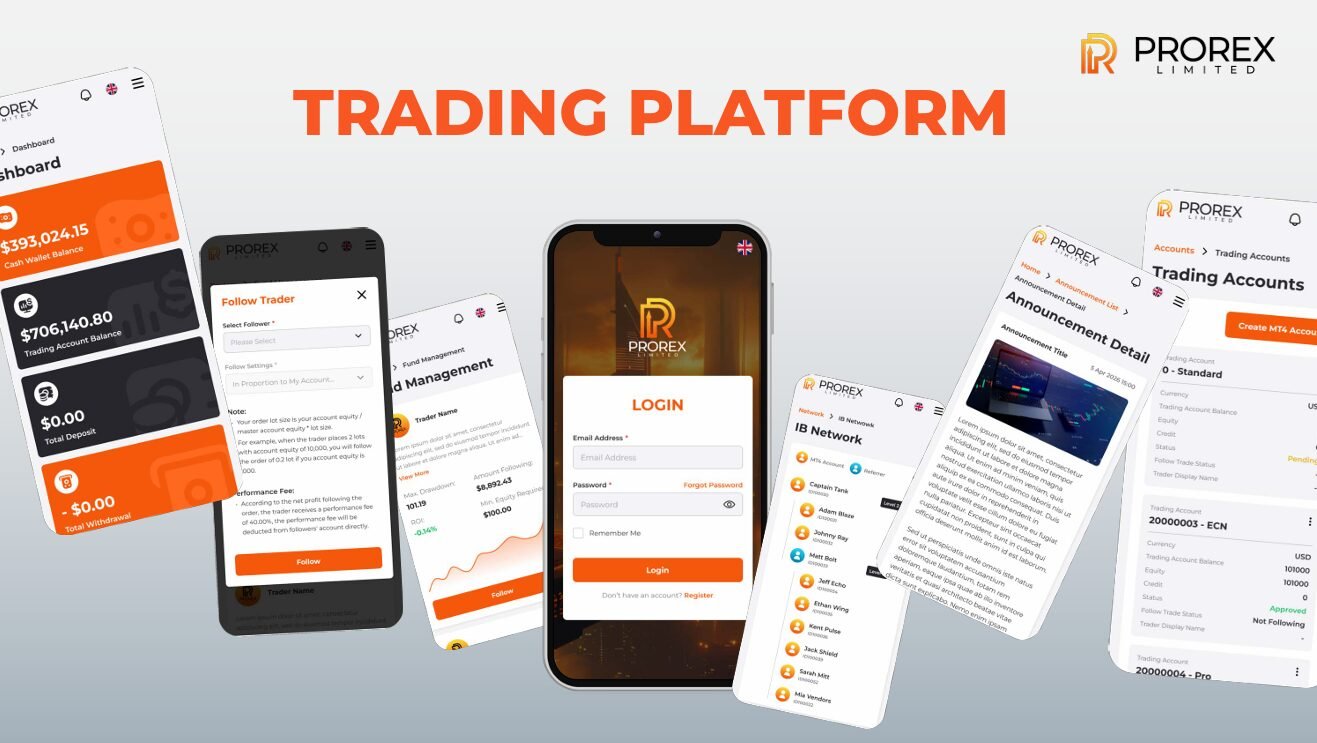

The system, he noted, thrives on transparency. Investors can see fee structures—whether management fees, performance fees, or subscription options—before committing. Combined with ultra-low spreads, fast execution speeds, and the MetaTrader 5 platform, this makes participation feel more grounded and reliable.

Prorex Pamm Trader vs. Copy Trading—An Interview Insight

Naturally, the conversation turned to how PAMM compares with copy trading. A seasoned trader put it this way: “Copy trading is like following someone’s footsteps in real time, while Prorex Pamm Trader is more like joining a guided journey where results are shared fairly among participants.”

This distinction highlights Prorex’s dual offering. Investors can choose copy trading if they prefer direct mirroring, or PAMM accounts for structured allocation with real-time reporting. Both options co-exist, giving clients flexibility depending on whether they seek immediacy or long-term strategy alignment.

The Human Angle: Confidence in a Regulated Framework

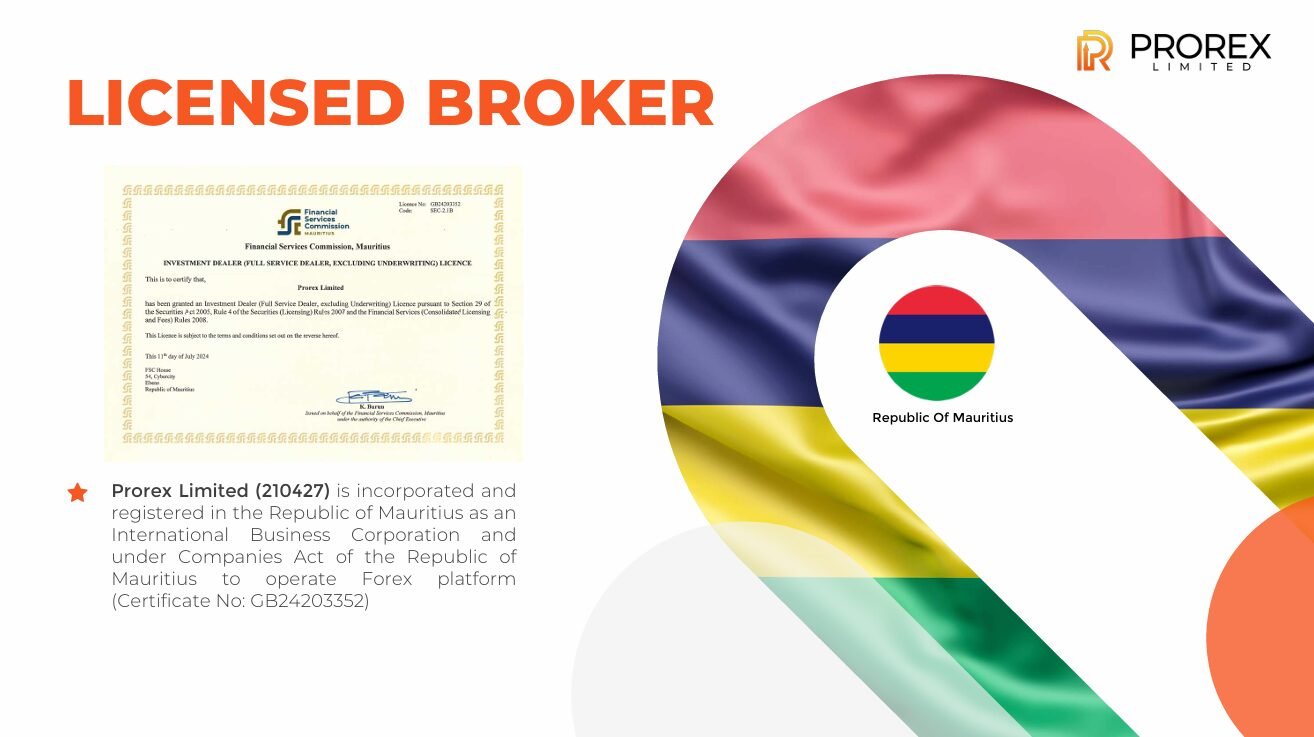

In speaking with retail investors, a recurring theme emerged—confidence. Many appreciated that Prorex Limited operates as a licensed broker under the Mauritius FSC. “It’s not just about technology,” one investor shared, “it’s about knowing that the system is regulated, transparent, and designed with accountability in mind.”

That sense of trust is reinforced through Prorex’s fund manager module, where strategy providers can publish their methods, set bespoke conditions, and grow their network. At the same time, clients benefit from real-time access to performance metrics, making informed decisions instead of blind guesses.

Conclusion: A Columnist’s Take on Prorex Pamm Trader

After listening to both professionals and retail investors, one observation became clear. Prorex Pamm Trader is more than just a feature on a trading platform. It is part of a broader cultural shift in how people approach investing—away from guesswork and towards structured, transparent, and technology-driven solutions. While no system can erase risk, Prorex has positioned itself as a broker. That blends regulation, innovation, and accessibility, making PAMM accounts a compelling choice for the years ahead.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia